Market Analysis

In-depth Analysis of Automotive Fasteners Market Industry Landscape

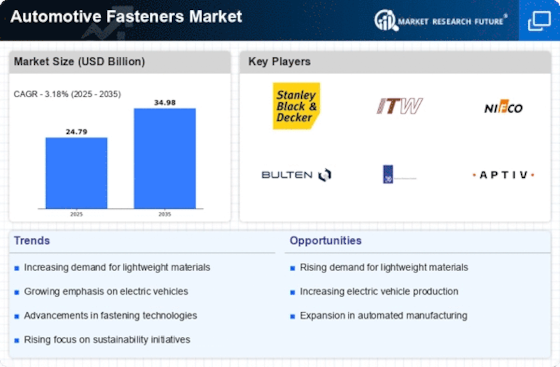

The automotive fasteners market is set to reach US$ 53 BN by 2030, at a 5.95% CAGR between years 2022-2030. The market is an important part of the whole automotive sphere in general, being responsible for vehicle assembly and functionality. A number of factors shape the competitive landscape for manufacturers, suppliers and consumers in this market that is home to a diverse set of dynamics. The overall demand for automobiles is one of the basic factors driving market dynamics. During the economic cycles of demand for automotive products fluctuate, fastener requirements including nuts bolts screws and rivets also change accordingly. The conditions of the economy, consumer requirements and world events influence vehicle sales that in turn affect the demand for fasteners. Secondly, technological developments in the automotive industry play a key role in market supply and demand of automotive fasteners. With the evolution of vehicles through innovation in technologies like electric and hybrid, lightweight materials as well as advanced safety features alike changes rapidly specifications and requirements of fasteners. This requires designing custom fancy fasteners that can address the specific requirements of modern automotive applications. A continuous adaptation in the market players is necessary to keep up with these changes due top technological advances, so that they provide solutions for automakers meeting evolving needs. Another important factor that drives market dynamics is the global supply chain. Automotive fasteners are usually procured from different regions and any disruption in the supply chain can spark off a ripple effect on production. Events natural disasters, geopolitical tensions, or global health crises which suppress production and distribution of fasteners can cause shortages for them to become expensive. Consequently, market players should closely monitor their supply chains and diversify sources to reduce threats from unexpected disruptions. However, regulatory standards and environmental considerations are important factors in driving the market dynamics of automotive fasteners. With an ever-greater focus on environmental sustainability and fuel efficiency, there has been a consistent requirement for lightweight materials in the auto industry. This in turn determines the type of fasteners, impelling manufacturers into lightweight materials devoicing body strength and durability. Moreover, the design and manufacturing procedures of emissions and safety regulations are also determined which affects the requirements for fasteners that comply with these standards. The dynamics of the automotive fasteners market are also contributed by competitive forces operating within it. The industry comprises a number of suppliers from big international companies down to small regional ones. Competition drives innovation, cost reduction strategies and the creation of niche products to become more competitive.

Leave a Comment