Shift Towards Electrification

The ongoing shift towards electrification in the automotive sector is reshaping the Automotive Exhaust Gas Aftertreatment Market. As manufacturers increasingly focus on electric vehicles (EVs) and hybrid models, the demand for traditional exhaust aftertreatment systems is evolving. However, even in hybrid vehicles, aftertreatment systems remain essential for optimizing emissions during combustion phases. The International Energy Agency reported that the share of electric vehicles in new car sales reached 10% in 2023, indicating a significant transition. This shift necessitates the development of innovative aftertreatment solutions that can cater to both conventional and electrified powertrains. Consequently, the market is likely to see a diversification of products that address the unique requirements of hybrid and electric vehicles, ensuring compliance with emissions standards while enhancing overall vehicle performance.

Focus on Sustainable Materials

Sustainability is becoming a pivotal driver in the Automotive Exhaust Gas Aftertreatment Market, as manufacturers seek to reduce their environmental footprint. The use of sustainable materials in the production of aftertreatment systems is gaining traction, with companies exploring alternatives to traditional metals and ceramics. This trend aligns with the broader automotive industry's commitment to sustainability and reducing greenhouse gas emissions. In 2023, approximately 25% of automotive manufacturers reported initiatives aimed at incorporating recycled materials into their exhaust systems. This focus on sustainability not only enhances the environmental profile of vehicles but also appeals to increasingly eco-conscious consumers. As the market evolves, the integration of sustainable practices in the design and manufacturing of aftertreatment systems is expected to become a key differentiator among competitors.

Regulatory Compliance and Innovation

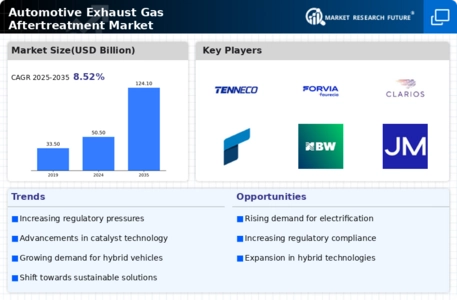

The Automotive Exhaust Gas Aftertreatment Market is significantly influenced by stringent regulatory frameworks aimed at reducing vehicular emissions. Governments worldwide are implementing increasingly rigorous standards, such as Euro 6 and EPA regulations, which mandate lower NOx and particulate matter emissions. This regulatory pressure compels manufacturers to innovate and invest in advanced aftertreatment technologies, such as selective catalytic reduction (SCR) and diesel particulate filters (DPF). As a result, the market is witnessing a surge in demand for efficient aftertreatment systems that comply with these regulations. In 2023, the market for automotive exhaust gas aftertreatment systems was valued at approximately USD 30 billion, reflecting the growing need for compliance-driven solutions. This trend is expected to continue, driving further advancements in technology and increasing market opportunities.

Technological Advancements in Aftertreatment Systems

Technological advancements play a crucial role in shaping the Automotive Exhaust Gas Aftertreatment Market. Innovations such as advanced sensors, real-time monitoring systems, and improved catalyst formulations are enhancing the efficiency and effectiveness of aftertreatment solutions. These technologies enable better performance in reducing harmful emissions, thus meeting stringent regulatory requirements. In 2023, the introduction of next-generation catalysts has shown a potential reduction in NOx emissions by up to 90%, significantly impacting the market landscape. Furthermore, the integration of artificial intelligence and machine learning in aftertreatment systems is paving the way for predictive maintenance and optimized performance. As these technologies continue to evolve, they are likely to drive market growth by offering enhanced solutions that address both regulatory compliance and consumer expectations.

Increasing Consumer Awareness and Demand for Clean Vehicles

Consumer awareness regarding environmental issues is rising, significantly impacting the Automotive Exhaust Gas Aftertreatment Market. As individuals become more informed about the effects of vehicle emissions on air quality and climate change, there is a growing demand for cleaner vehicles equipped with effective aftertreatment systems. Surveys indicate that over 60% of consumers in 2023 prioritize low-emission vehicles when making purchasing decisions. This shift in consumer preference is prompting manufacturers to enhance their aftertreatment technologies to meet these expectations. Consequently, the market is experiencing increased investment in research and development aimed at creating more efficient and effective exhaust gas aftertreatment solutions. This trend not only supports regulatory compliance but also aligns with the broader societal push towards sustainability and environmental responsibility.

Leave a Comment