Technological Advancements

The Global Automotive Digital Transformation Market Industry is propelled by rapid technological advancements, particularly in artificial intelligence and machine learning. These technologies enhance vehicle connectivity and automation, leading to improved safety and efficiency. For instance, the integration of AI in autonomous driving systems has shown promising results, with companies investing heavily in R&D. The market is projected to reach 235.94 USD Billion in 2024, indicating a robust growth trajectory. As manufacturers adopt these technologies, the industry is likely to witness an increase in consumer demand for smart vehicles, further driving digital transformation.

Investment in Electric Vehicles

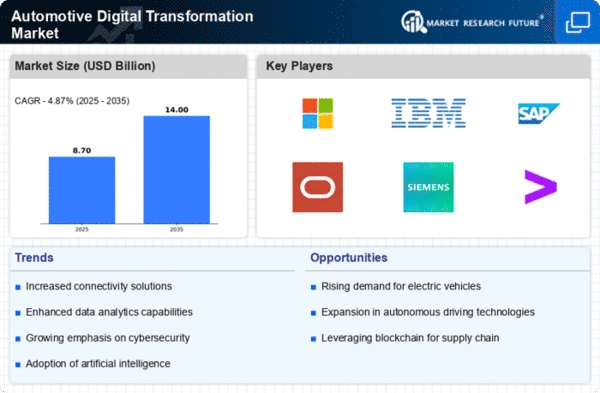

The Global Automotive Digital Transformation Market Industry is significantly influenced by the rising investment in electric vehicles (EVs). As manufacturers pivot towards sustainable mobility solutions, the integration of digital technologies in EVs becomes paramount. This includes advancements in battery management systems and smart charging infrastructure. The market is anticipated to grow at a CAGR of 7.84% from 2025 to 2035, reflecting the increasing focus on electrification and digitalization. Companies are likely to leverage digital tools to enhance the performance and user experience of EVs, thus driving the overall digital transformation within the automotive sector.

Emergence of Mobility-as-a-Service

The Global Automotive Digital Transformation Market Industry is witnessing the emergence of Mobility-as-a-Service (MaaS), which reshapes traditional transportation models. MaaS integrates various transportation services into a single accessible platform, allowing users to plan, book, and pay for multiple modes of transport seamlessly. This trend is gaining traction as urbanization increases and consumers seek more flexible mobility solutions. The market's growth is indicative of a broader shift towards digital solutions in transportation, with projections suggesting a substantial increase in value over the coming years. The integration of MaaS into the automotive landscape is likely to enhance the digital transformation process.

Consumer Demand for Connected Vehicles

The Global Automotive Digital Transformation Market Industry experiences a surge in consumer demand for connected vehicles, which offer enhanced features such as real-time navigation, infotainment systems, and vehicle-to-everything (V2X) communication. This trend is evident as consumers increasingly prioritize connectivity and convenience in their automotive choices. In 2024, the market is expected to be valued at 235.94 USD Billion, reflecting the growing importance of digital features in vehicle purchasing decisions. Manufacturers are responding by integrating advanced connectivity solutions, which not only improve user experience but also contribute to the overall digital transformation of the automotive sector.

Regulatory Support for Digital Initiatives

The Global Automotive Digital Transformation Market Industry benefits from increasing regulatory support aimed at promoting digital initiatives. Governments worldwide are implementing policies that encourage the adoption of electric vehicles and smart technologies, which are integral to digital transformation. For example, various countries have set ambitious targets for reducing carbon emissions, thereby incentivizing manufacturers to innovate. This regulatory environment is expected to foster growth, with the market projected to expand significantly, reaching 541.32 USD Billion by 2035. Such supportive measures are likely to accelerate the transition towards a more digitized automotive landscape.