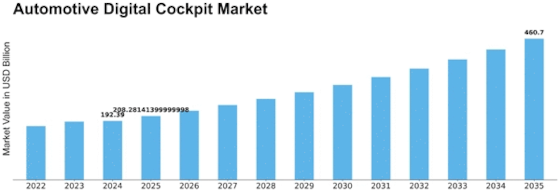

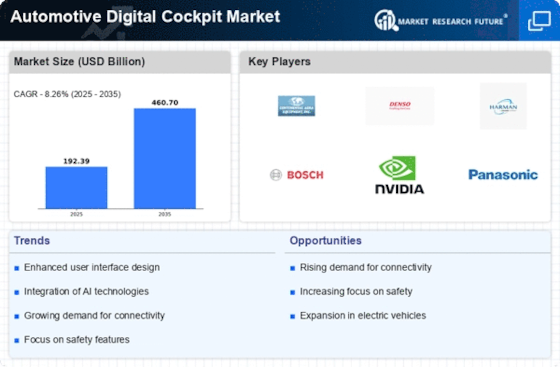

Automotive Digital Cockpit Size

Automotive Digital Cockpit Market Growth Projections and Opportunities

A car's head-up display (HUD) is like a see-through screen projected onto the windshield, showing information you'd normally find on the dashboard, like how fast you're going, the engine speed, and directions from the navigation system. In 2020, the global market for these automotive head-up displays was worth USD 1,114.3 million, and experts predict it will reach USD 5,367.4 million by 2027, growing at a rate of 25.5% each year. Europe led the market in 2020, making up 35.2%, followed by North America with 26.5%, and Asia-Pacific with 26.1%. This market is divided into different parts based on things like what it's made of, what type it is, the technology it uses, what kind of fuel the car uses, and who uses it. Looking at what it's made of, the display units part was the biggest in 2020, making up 27.4% and valued at USD 305.4 million. It's expected to keep growing at a rate of 28.5% each year. When it comes to the type of head-up display, the windshield HUD part was the most popular, making up 79.2% and valued at USD 882.6 million in 2020. It's predicted to keep growing at a rate of 24.5%. In terms of technology, the regular or "conventional" type was the most common, making up 72.9% and valued at USD 812.6 million in 2020. It's expected to keep growing at a rate of 24.4%. Looking at the fuel type, cars that use internal combustion engines (ICE) were the most common, making up 90.3% and valued at USD 1,006.6 million in 2020. It's predicted to keep growing at a rate of 23.9%. Lastly, in terms of who uses it, luxury cars led the way with 50.3% and were valued at USD 560.3 million in 2020. It's expected to keep growing at a rate of 24.1%.

So, in simpler terms, the head-up display in cars is like a special see-through screen on the windshield that shows important information. The market for these displays is growing really fast, and Europe led the way in 2020, with North America and Asia-Pacific following close behind. The different parts of the market, like what the display is made of, what type it is, the technology it uses, the kind of fuel the car uses, and who uses it, all contribute to this growth. For example, the display units part is growing a lot, and so is the kind that shows information on the windshield. Regular technology is still the most common, and most cars with these displays use regular gasoline. Luxury cars are the ones that use this feature the most, and they are expected to keep using it more and more in the coming years.

Leave a Comment