Growth of the Automotive Aftermarket

The Automotive Cylinder Liner Market is also benefiting from the growth of the automotive aftermarket. As vehicles age, the need for replacement parts, including cylinder liners, becomes more pronounced. The aftermarket segment is projected to grow at a rate of around 5% annually, driven by an increasing number of vehicles on the road and the rising average age of these vehicles. This trend creates a substantial opportunity for manufacturers to supply high-quality cylinder liners that meet the demands of older engine models. Additionally, the growing trend of vehicle customization and performance enhancement further fuels the demand for specialized cylinder liners, thereby contributing to the expansion of the Automotive Cylinder Liner Market.

Increasing Demand for Fuel Efficiency

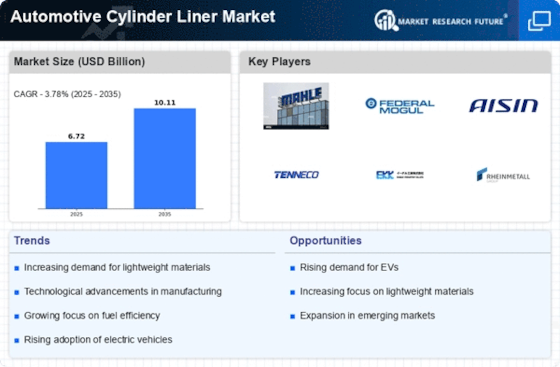

The Automotive Cylinder Liner Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and produce engines that maximize fuel economy. Cylinder liners play a crucial role in enhancing engine performance and efficiency. According to recent data, the automotive sector is projected to witness a compound annual growth rate of approximately 4.5% in the coming years, driven by the need for reduced emissions and improved fuel consumption. This trend indicates a growing market for advanced cylinder liners that contribute to lighter and more efficient engine designs, thereby propelling the Automotive Cylinder Liner Market forward.

Regulatory Pressure for Emission Reductions

Regulatory pressure for emission reductions is a significant driver for the Automotive Cylinder Liner Market. Governments worldwide are implementing stringent emission standards to combat climate change and improve air quality. This regulatory environment compels automotive manufacturers to invest in technologies that reduce emissions, including the development of more efficient cylinder liners. The market is witnessing a shift towards liners that can support cleaner combustion processes and lower emissions. Data indicates that compliance with these regulations is expected to drive innovation in cylinder liner technology, leading to the introduction of products that not only meet but exceed regulatory requirements, thus fostering growth in the Automotive Cylinder Liner Market.

Technological Advancements in Engine Design

Technological advancements in engine design are significantly influencing the Automotive Cylinder Liner Market. Innovations such as variable valve timing and turbocharging require cylinder liners that can withstand higher pressures and temperatures. The introduction of advanced materials and manufacturing techniques, such as precision casting and machining, enhances the durability and performance of cylinder liners. Market data suggests that the demand for high-performance engines is expected to rise, with a projected increase in the use of aluminum and composite materials in cylinder liner production. This shift not only improves engine efficiency but also aligns with the industry's focus on sustainability, thereby driving growth in the Automotive Cylinder Liner Market.

Rising Popularity of High-Performance Vehicles

The rising popularity of high-performance vehicles is another key driver for the Automotive Cylinder Liner Market. Enthusiasts and consumers are increasingly seeking vehicles that offer superior power and handling, which necessitates advanced engine components, including high-quality cylinder liners. The performance vehicle segment is anticipated to grow significantly, with a projected increase in sales of sports cars and luxury vehicles. This trend creates a demand for cylinder liners that can withstand the rigors of high-performance applications, thereby driving innovation and investment in the Automotive Cylinder Liner Market. Manufacturers are likely to focus on developing liners that enhance engine output while maintaining reliability and efficiency.