Expansion of Aftermarket Services

The Automotive Connecting Rod Market is benefiting from the expansion of aftermarket services, which is becoming increasingly vital in the automotive sector. As vehicle ownership rates rise, the demand for replacement parts, including connecting rods, is also increasing. The aftermarket segment is projected to grow at a rate of 5% annually, driven by the need for maintenance and repair services. This trend presents opportunities for manufacturers to diversify their product offerings and cater to a broader customer base. The Automotive Connecting Rod Market is thus likely to see enhanced growth as companies focus on providing high-quality replacement parts that meet the needs of both consumers and service providers.

Increasing Vehicle Production Rates

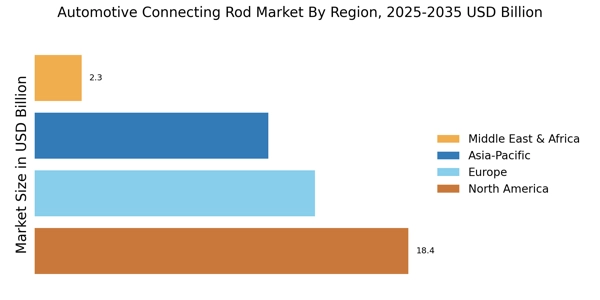

The Automotive Connecting Rod Market is significantly influenced by the increasing production rates of vehicles across various segments. As consumer demand for automobiles rises, manufacturers are ramping up production to meet this need. In 2025, it is estimated that vehicle production will reach approximately 90 million units, which directly correlates with the demand for connecting rods. This increase in production not only boosts the volume of connecting rods required but also encourages manufacturers to innovate and improve their product offerings. The Automotive Connecting Rod Market is thus poised for growth, as the need for reliable and efficient components becomes more critical in the face of rising production levels.

Rising Demand for High-Performance Vehicles

The Automotive Connecting Rod Market is witnessing a notable shift towards high-performance vehicles, which is driving demand for specialized connecting rods. As consumers increasingly seek vehicles that offer superior performance, manufacturers are compelled to invest in advanced engineering solutions. High-performance engines require connecting rods that can endure greater loads and stresses, leading to innovations in design and materials. This trend is supported by market data indicating that the high-performance vehicle segment is expected to grow at a rate of 6% annually through 2025. Consequently, the Automotive Connecting Rod Market is likely to benefit from this demand, as manufacturers focus on producing connecting rods that meet the rigorous standards of high-performance applications.

Technological Advancements in Engine Design

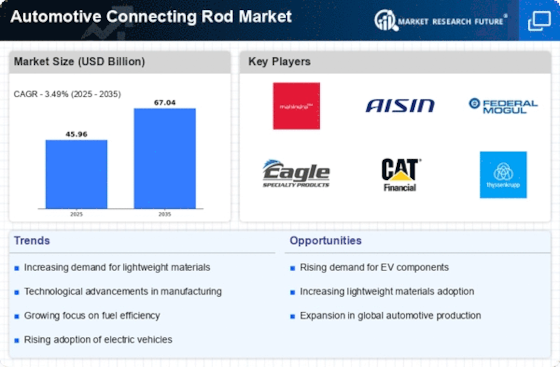

The Automotive Connecting Rod Market is experiencing a surge in demand due to rapid technological advancements in engine design. Innovations such as variable valve timing and turbocharging necessitate the development of connecting rods that can withstand higher stress and temperatures. As manufacturers strive to enhance engine efficiency and performance, the need for lightweight yet durable materials becomes paramount. This trend is reflected in the projected growth of the automotive sector, with the connecting rod market expected to expand at a compound annual growth rate of approximately 4.5% over the next five years. Consequently, the integration of advanced materials and manufacturing techniques is likely to drive the Automotive Connecting Rod Market forward, as companies seek to optimize engine performance while adhering to stringent emissions regulations.

Regulatory Compliance and Emission Standards

The Automotive Connecting Rod Market is significantly shaped by stringent regulatory compliance and emission standards imposed by governments worldwide. As environmental concerns escalate, manufacturers are compelled to develop engines that not only perform efficiently but also adhere to lower emission levels. This has led to innovations in connecting rod design, as lighter and more efficient components are required to optimize engine performance while minimizing emissions. The Automotive Connecting Rod Market is expected to see a shift towards more sustainable practices, with a projected increase in demand for connecting rods that support eco-friendly engine technologies. This regulatory landscape is likely to drive growth in the market as manufacturers adapt to meet these evolving standards.