Growing Electric Vehicle Adoption

The rise of electric vehicles (EVs) is a transformative trend impacting the Automotive Composites Market. As automakers pivot towards electrification, the demand for lightweight and high-performance materials becomes increasingly critical. Composites are particularly well-suited for EV applications, as they help offset the weight of heavy batteries, thereby enhancing range and efficiency. The EV market is anticipated to grow exponentially, with estimates suggesting that electric vehicles could account for a substantial percentage of total vehicle sales in the coming years. This shift not only drives demand for automotive composites but also encourages innovation in material development, as manufacturers seek to optimize performance and sustainability in their electric offerings.

Increasing Demand for Lightweight Materials

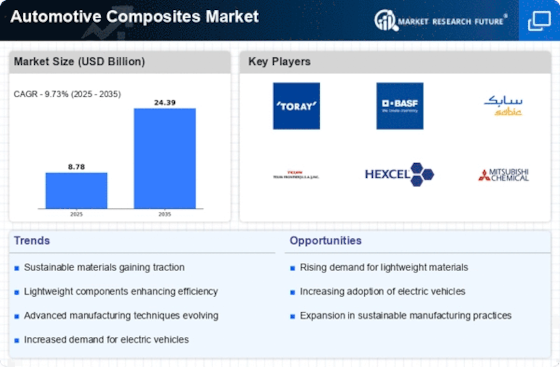

The Automotive Composites Market is experiencing a notable surge in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Composites, such as carbon fiber and glass fiber, offer significant weight reductions compared to traditional materials like steel and aluminum. This shift is particularly relevant as regulations on emissions become more stringent, compelling manufacturers to innovate. In fact, the market for automotive composites is projected to grow at a compound annual growth rate of approximately 10% over the next few years. This growth is indicative of a broader trend towards sustainability and efficiency in vehicle design, as automakers increasingly prioritize materials that contribute to overall performance while minimizing environmental impact.

Regulatory Pressure for Emission Reductions

The Automotive Composites Market is significantly influenced by regulatory frameworks aimed at reducing vehicle emissions. Governments worldwide are implementing stringent regulations that mandate lower carbon footprints for new vehicles. This regulatory pressure is compelling automotive manufacturers to explore alternative materials, such as composites, which can help achieve these targets. Composites not only contribute to lighter vehicle designs but also enhance fuel efficiency, thereby aligning with regulatory goals. As a result, the market for automotive composites is expected to expand, with projections indicating a potential increase in market share as manufacturers seek compliant solutions. This dynamic illustrates the interplay between regulatory environments and material innovation in the automotive sector.

Advancements in Composite Manufacturing Technologies

Technological innovations in manufacturing processes are playing a pivotal role in the Automotive Composites Market. Techniques such as automated fiber placement and resin transfer molding are enhancing the efficiency and scalability of composite production. These advancements not only reduce production costs but also improve the quality and consistency of composite materials. As a result, manufacturers are more inclined to adopt composites in their vehicle designs. The integration of advanced manufacturing technologies is expected to drive the market forward, with estimates suggesting that the automotive composites segment could reach a valuation of several billion dollars by the end of the decade. This trend underscores the importance of continuous innovation in maintaining competitiveness within the automotive sector.

Consumer Preference for Enhanced Vehicle Performance

Consumer expectations regarding vehicle performance are evolving, significantly impacting the Automotive Composites Market. Today's consumers are increasingly prioritizing attributes such as acceleration, handling, and overall driving experience. Composites, known for their strength-to-weight ratio, are becoming a preferred choice for manufacturers aiming to enhance vehicle dynamics. This trend is particularly evident in the performance and luxury vehicle segments, where the use of advanced composites can lead to superior performance characteristics. As consumer preferences continue to shift towards high-performance vehicles, the demand for automotive composites is likely to increase, fostering a competitive landscape where manufacturers must innovate to meet these expectations.