- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

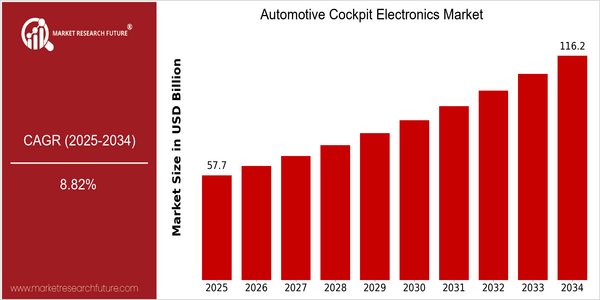

| Year | Value |

|---|---|

| 2025 | USD 57.72 Billion |

| 2034 | USD 116.18 Billion |

| CAGR (2025-2034) | 8.82 % |

Note – Market size depicts the revenue generated over the financial year

The Automotive Cockpit Electronics Market is poised for significant growth, with a current market size of USD 57.72 billion in 2025, projected to nearly double to USD 116.18 billion by 2034. This robust growth trajectory reflects a compound annual growth rate (CAGR) of 8.82% over the forecast period. The increasing integration of advanced technologies such as infotainment systems, driver assistance features, and connectivity solutions are key drivers propelling this market forward. As consumers demand more sophisticated in-car experiences, automakers are investing heavily in cockpit electronics to enhance user engagement and safety. Technological advancements, particularly in areas like artificial intelligence, machine learning, and the Internet of Things (IoT), are transforming the automotive cockpit landscape. Companies such as Bosch, Continental, and Harman are at the forefront of this evolution, actively pursuing strategic initiatives including partnerships and product innovations to capture market share. For instance, Harman's recent collaborations with leading automotive manufacturers to develop next-generation infotainment systems exemplify the industry's commitment to enhancing the driving experience. As the market continues to expand, these trends will likely shape the future of automotive cockpit electronics, driving further investment and innovation in the sector.

Regional Market Size

Regional Deep Dive

The Automotive Cockpit Electronics Market is experiencing significant transformation across various regions, driven by advancements in technology, increasing consumer demand for enhanced in-vehicle experiences, and regulatory pressures for safety and connectivity. Each region exhibits unique characteristics influenced by local automotive industries, consumer preferences, and regulatory environments, which collectively shape the market dynamics. As automakers and technology companies collaborate to integrate sophisticated cockpit electronics, the market is poised for substantial growth, with innovations in infotainment systems, driver assistance technologies, and connectivity solutions leading the charge.

Europe

- Europe is at the forefront of innovation in automotive cockpit electronics, with companies like Volkswagen and BMW leading the charge in developing advanced infotainment systems that incorporate artificial intelligence and machine learning.

- The European Union's stringent regulations on emissions and safety are prompting manufacturers to invest in more efficient cockpit technologies, which are expected to enhance user experience while complying with environmental standards.

Asia Pacific

- Asia-Pacific is rapidly evolving as a hub for automotive cockpit electronics, with major players like Toyota and Honda focusing on integrating smart technologies into their vehicles to cater to tech-savvy consumers.

- The region's growing emphasis on electric vehicles (EVs) is driving innovations in cockpit electronics, as manufacturers seek to create seamless user interfaces that enhance the driving experience and promote sustainability.

Latin America

- Latin America is witnessing a gradual shift towards modern cockpit electronics, with local manufacturers beginning to adopt advanced infotainment systems to meet the rising consumer expectations for connectivity and entertainment.

- The region's economic challenges have led to a focus on cost-effective solutions, prompting companies to innovate in affordable cockpit technologies that still offer essential features and functionalities.

North America

- The North American market is witnessing a surge in demand for advanced driver-assistance systems (ADAS), with companies like Tesla and General Motors investing heavily in cockpit electronics to enhance safety features and user experience.

- Recent regulatory changes, such as the National Highway Traffic Safety Administration's (NHTSA) push for vehicle-to-everything (V2X) communication, are driving automakers to adopt more integrated cockpit solutions that improve connectivity and safety.

Middle East And Africa

- In the Middle East and Africa, the automotive cockpit electronics market is influenced by the increasing adoption of luxury vehicles, with brands like Mercedes-Benz and Audi incorporating high-end cockpit technologies to attract affluent consumers.

- Government initiatives aimed at improving road safety and infrastructure are encouraging investments in advanced cockpit electronics, which are expected to enhance vehicle connectivity and driver assistance features.

Did You Know?

“Did you know that the average modern vehicle contains over 100 million lines of code, which is more than the software used in a typical commercial airplane?” — Source: Automotive Industry Insights

Segmental Market Size

The Automotive Cockpit Electronics segment plays a crucial role in enhancing user experience and vehicle functionality, currently experiencing stable growth driven by increasing consumer demand for advanced infotainment systems and connectivity features. Key factors propelling this segment include the rising consumer preference for integrated digital experiences and regulatory policies promoting vehicle safety and connectivity standards. Additionally, technological advancements in artificial intelligence and machine learning are enabling more sophisticated cockpit systems. Currently, the adoption stage of Automotive Cockpit Electronics is in the scaled deployment phase, with companies like Tesla and BMW leading the charge in integrating advanced cockpit technologies into their vehicles. Primary applications include infotainment systems, driver assistance displays, and vehicle-to-everything (V2X) communication interfaces. Notable trends accelerating growth include the push for electric vehicles and sustainability initiatives, which are prompting manufacturers to innovate in cockpit design and functionality. Technologies such as augmented reality displays and voice recognition systems are shaping the evolution of this segment, enhancing user interaction and safety.

Future Outlook

The Automotive Cockpit Electronics Market is poised for significant growth from 2025 to 2034, with a projected market value increase from $57.72 billion to $116.18 billion, reflecting a robust compound annual growth rate (CAGR) of 8.82%. This growth trajectory is underpinned by the increasing integration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), and the Internet of Things (IoT) into vehicle cockpit systems. As consumer demand for enhanced in-vehicle experiences rises, manufacturers are expected to invest heavily in developing sophisticated infotainment systems, driver assistance technologies, and personalized user interfaces, which will drive market penetration rates to approximately 75% by 2034, up from around 45% in 2025. Key technological drivers include the ongoing evolution of electric and autonomous vehicles, which necessitate more advanced cockpit electronics to support complex functionalities and user interactions. Additionally, regulatory policies aimed at improving vehicle safety and reducing emissions are likely to accelerate the adoption of smart cockpit solutions. Emerging trends such as the shift towards connected vehicles and the growing importance of cybersecurity in automotive electronics will further shape the market landscape. As a result, stakeholders in the automotive sector must remain agile and innovative to capitalize on these trends and meet the evolving expectations of consumers in the coming decade.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 42.3 Billion |

| Market Size Value In 2023 | USD 30.8 Billion |

| Growth Rate | 8.25% (2023-2032) |

Automotive Cockpit Electronics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.