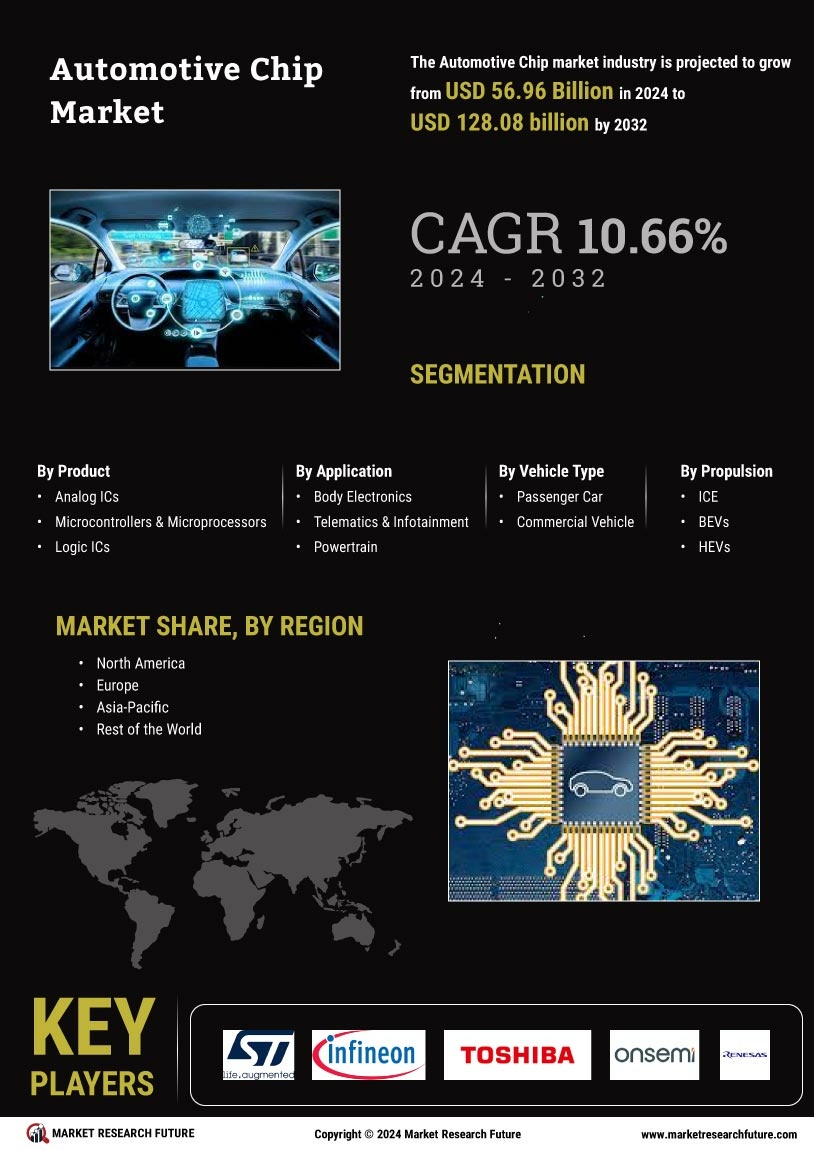

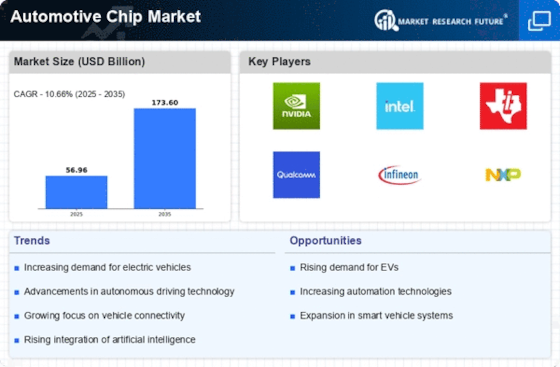

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the Automotive Chip Market. As automakers pivot towards electrification, the demand for specialized chips that manage battery systems, power electronics, and electric drivetrains surges. In 2025, it is estimated that EVs will account for approximately 30% of total vehicle sales, necessitating a robust supply of automotive chips. This shift not only enhances the performance and efficiency of EVs but also propels the Automotive Chip Market into a new era of innovation. The integration of advanced semiconductor technologies is crucial for optimizing energy consumption and extending vehicle range, thereby attracting more consumers to the EV segment.

Increased Connectivity and IoT Integration

The proliferation of connected vehicles is reshaping the Automotive Chip Market. As vehicles become more integrated with the Internet of Things (IoT), the demand for chips that facilitate communication between vehicles and external networks is escalating. By 2025, it is anticipated that over 70% of new vehicles will be equipped with some form of connectivity, driving the need for advanced automotive chips. These chips enable features such as real-time traffic updates, remote diagnostics, and over-the-air software updates, enhancing the overall user experience. The Automotive Chip Market must adapt to these trends by developing chips that not only support connectivity but also ensure data security and privacy, which are becoming increasingly important in the automotive sector.

Regulatory Compliance and Safety Standards

The Automotive Chip Market is also shaped by stringent regulatory compliance and safety standards. Governments worldwide are implementing regulations that mandate the use of advanced safety features in vehicles, which in turn drives the demand for specialized automotive chips. For instance, regulations requiring electronic stability control and advanced airbag systems necessitate the integration of sophisticated semiconductor solutions. By 2025, it is expected that compliance with these regulations will require a significant increase in the production of automotive chips, as manufacturers strive to meet safety benchmarks. This regulatory landscape not only influences the design and functionality of automotive chips but also encourages innovation within the Automotive Chip Market, as companies seek to develop solutions that exceed safety requirements.

Advancements in Autonomous Driving Technologies

The Automotive Chip Market is significantly influenced by the rapid advancements in autonomous driving technologies. As vehicles become increasingly equipped with advanced driver-assistance systems (ADAS), the need for high-performance chips that can process vast amounts of data in real-time becomes paramount. By 2025, the market for autonomous vehicles is projected to reach a valuation of over 60 billion dollars, highlighting the critical role of automotive chips in enabling features such as lane-keeping assistance, adaptive cruise control, and collision avoidance. These chips must not only be powerful but also reliable, as they are integral to ensuring passenger safety and enhancing the overall driving experience. Consequently, the Automotive Chip Market is poised for substantial growth as manufacturers invest in the development of sophisticated semiconductor solutions.

Growing Focus on Vehicle Electrification and Efficiency

The Automotive Chip Market is experiencing a notable shift towards vehicle electrification and efficiency. As manufacturers aim to reduce emissions and improve fuel economy, the demand for chips that optimize engine performance and energy management systems is rising. By 2025, it is projected that the market for automotive chips related to hybrid and electric vehicles will grow significantly, driven by the need for enhanced energy efficiency. These chips play a crucial role in managing power distribution, regenerative braking, and thermal management, which are essential for maximizing vehicle performance. The Automotive Chip Market must continue to innovate in this area, developing chips that not only meet current efficiency standards but also anticipate future regulatory requirements and consumer expectations.