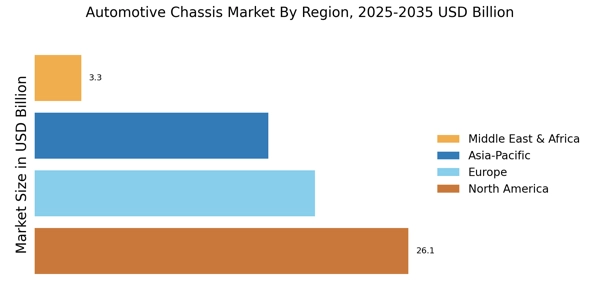

Based on region, the Automotive Chassis Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America accounted for the largest market share in 2024 and is anticipated to reach USD 60,969.1 Million by 2035. Asia-Pacific is projected to grow at the highest CAGR of 6.8% during the forecast period.

Europe: Lightweight design and electrification

Europe is a mature market, with stringent regulations on emissions, high emphasis on the lightweight vehicle architecture, and the high use of electric and hybrid vehicles. Manufacturers within the region are also committing more investments in modular and scalable chassis platforms in order to achieve sustainability goals. Moreover, the existence of major automotive manufacturers and the ongoing research and development of new materials and structural design remain a source of drive to automotive chassis systems demand.

North America: Advanced vehicles and safety norms

In North America, an increase in the demand of pickup trucks, SUVs, and luxury passenger vehicles has propelled the Automotive Chassis market in which robust and lightweight chassis systems are essential to the market in terms of performance and safety. Tougher vehicle safety laws and fuel efficiency policies are pushing auto manufacturers towards using new high strength steel and aluminum chassis material. Moreover, the increasing adoption of electric vehicles and the constant modernization of vehicle platforms by large OEMs are facilitating market development in the area.

South America: Gradual production recovery

The market of Automotive Chassis in South America is steadily growing, which is backed by the restoration of the automotive production and the increase in the demand of the affordable passenger and light commercial vehicles. The move towards better chassis systems is being facilitated by the increase of global OEM investments in regional manufacturing plants and slow but steady advances in the safety standards of vehicles. In addition, the development of infrastructure and the recovery of economies of major nations is helping the expansion of the market.

Asia-pacific: High Vehicle Production Volume

The Asia-Pacific region dominates the Automotive Chassis Market which is driven by the high vehicle production volumes in countries such as China, India, Japan, and South Korea. Chin being the world’s largest automotive market leads in the adoption of electric vehicle chassis platforms with some key manufacturers like BYD, NIO, and SAIC Motor developing integrated skateboard architectures to support the rapid growth of EV. Japan and South Korea is a home to Toyota, Honda, Hyundai, and Kia are leading in the the use of lightweight materials and modular chassis systems, particularly to increase the fuel efficiency and hybrid vehicle performance. India, on the other hand shows strong growth potential in the commercial vehicle chassis segment which is fueled by the infrastructure development, urbanization and the government’s Make in India and EV mobility initiatives. Additionally, regional suppliers like Aisin Seiki, Hyundai Mobis, and Tata Autocamp are investing in the advanced suspension and e-axle technologies tailored for both passenger and commercial vehicles. With increasing demand for affordable cars, it are coupled with strong government incentives for EV adoption. However, APAC is expected to remain the fastest-growing region for innovative chassis development by balancing both the mass-market and premium vehicle requirements.

Middle-East & Africa: Commercial and off-road demand

Market development in the Middle East and Africa is promoted by the growing demand in commercial vehicles, SUV, and off-road cars that are adapted to the difficult terrain and weather conditions. The chassis demand is being assisted by infrastructure development, increased logistics operations, and increased automotive imports. As well, the increase in investments in the transportation system in the region and the slow process of localizing vehicle assembly are also having a positive effect on market development.