Focus on User-Centric Design

In the Automotive Centre Stack Display Market, there is a pronounced emphasis on user-centric design principles. Manufacturers are increasingly prioritizing the needs and preferences of end-users, leading to the development of intuitive interfaces and customizable display options. This trend is reflected in the rising demand for touchscreens and voice-activated controls, which enhance the overall driving experience. Market data indicates that user-friendly designs can significantly influence consumer purchasing decisions, with studies showing that over 70% of consumers prefer vehicles equipped with advanced display technologies. As a result, automakers are investing heavily in research and development to create displays that not only meet functional requirements but also provide aesthetic appeal, thereby driving growth in the Automotive Centre Stack Display Market.

Enhanced Connectivity Features

The Automotive Centre Stack Display Market is significantly influenced by the growing demand for enhanced connectivity features in vehicles. As consumers increasingly rely on smartphones and other devices, the integration of connectivity solutions such as Apple CarPlay and Android Auto has become essential. These features allow for seamless interaction between the vehicle's display and personal devices, enhancing the overall user experience. Market data suggests that vehicles equipped with advanced connectivity options are more appealing to tech-savvy consumers, leading to higher sales figures. Consequently, automakers are prioritizing the development of centre stack displays that support these connectivity features, thereby driving innovation and growth within the Automotive Centre Stack Display Market.

Rising Demand for Electric Vehicles

The Automotive Centre Stack Display Market is witnessing a surge in demand driven by the increasing popularity of electric vehicles (EVs). As more consumers opt for EVs, the need for advanced display technologies that provide essential information about battery life, charging status, and energy consumption becomes critical. Market forecasts indicate that the EV segment is expected to grow at a remarkable pace, with projections suggesting that electric vehicles could represent a significant portion of total vehicle sales in the near future. This trend necessitates the development of specialized centre stack displays that cater to the unique requirements of EV users, thereby creating new opportunities within the Automotive Centre Stack Display Market.

Integration of Advanced Technologies

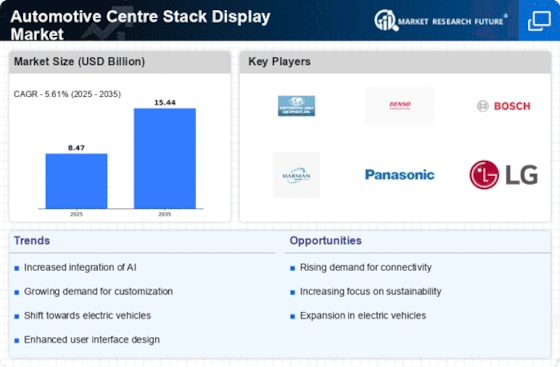

The Automotive Centre Stack Display Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence, augmented reality, and machine learning. These technologies enhance user interaction and provide real-time data analytics, which are increasingly demanded by consumers. The market for automotive displays is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for more sophisticated infotainment systems that offer seamless connectivity and enhanced user experiences. As automakers strive to differentiate their products, the incorporation of these advanced technologies into centre stack displays is likely to become a standard feature, thereby propelling the Automotive Centre Stack Display Market forward.

Sustainability and Eco-Friendly Solutions

The Automotive Centre Stack Display Market is increasingly aligning with sustainability trends, as consumers and manufacturers alike become more environmentally conscious. The demand for eco-friendly materials and energy-efficient technologies is on the rise, prompting manufacturers to innovate in their display solutions. For instance, the use of recycled materials in display production and the implementation of energy-saving features are becoming more prevalent. Market analysis suggests that the eco-friendly segment of the automotive display market could account for a substantial share, as consumers are willing to pay a premium for sustainable products. This shift not only addresses environmental concerns but also enhances brand loyalty among consumers who prioritize sustainability, thereby influencing the trajectory of the Automotive Centre Stack Display Market.