- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

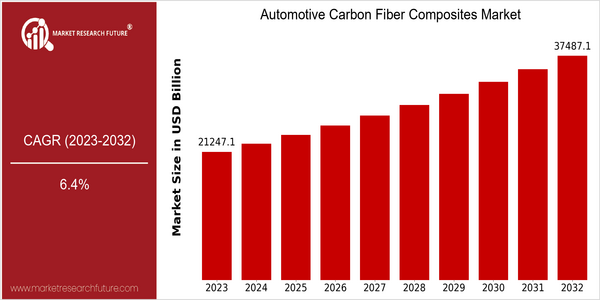

| Year | Value |

|---|---|

| 2023 | USD 21247.14 Billion |

| 2032 | USD 37487.1 Billion |

| CAGR (2023-2032) | 6.4 % |

Note – Market size depicts the revenue generated over the financial year

The global market for carbon fiber composites in the automobile industry is expected to grow significantly. It is estimated to be worth $ 21 billion in 2023, and it is expected to reach $ 37,487 billion by 2032. This growth reflects a high CAGR of 6.4% over the forecast period from 2023 to 2032. The demand for lightweight materials in the automobile industry, driven by stringent fuel economy standards and the need to reduce carbon emissions, is mainly responsible for the growth of this market. The development of carbon fiber production technology and the increasing use of electric vehicles (EVs) will also support market growth. Vehicle manufacturers want to improve the performance and efficiency of their products. In order to take advantage of this market, the major players in the automobile carbon fiber composites industry, such as Toray Industries, SGL Carbon, and Hexcel, have actively participated in the development of this industry. They are investing in R & D to develop new composite materials, and establishing strategic alliances to enhance their production capabilities. The industry is now more and more able to meet the needs of the auto industry. The industry is developing rapidly. The combination of technological developments and strategic initiatives will be the main factors driving the future development of the automobile carbon fiber composites industry.

Regional Market Size

Regional Deep Dive

The market for carbon-fibre composites in the automobile industry is experiencing significant growth in all regions, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce exhaust emissions. North America is characterized by a strong presence of automobile manufacturers and a growing focus on sustainable development. Europe leads in the regulatory frameworks promoting the use of advanced materials. In Asia-Pacific, the industrialization of the region and the growing production of electric vehicles are further increasing the demand for carbon-fibre composites. The Middle East and Africa are gradually adopting these materials, driven by the need to modernize the automobile industry, while Latin America is beginning to explore the potential of carbon-fibre composites in the automobile industry as part of its broader industrial development.

Europe

- The European Union's stringent emissions regulations are driving automakers to seek lightweight solutions, leading to increased investments in carbon fiber technologies by companies such as BMW and Audi.

- Innovative projects like the 'Lightweighting in Automotive' initiative are fostering collaboration between manufacturers and research institutions to develop advanced carbon fiber composites.

Asia Pacific

- China's rapid growth in electric vehicle production is creating a substantial demand for lightweight materials, with companies like BYD and NIO exploring carbon fiber composites to enhance vehicle efficiency.

- Japan's automotive giants, including Toyota and Honda, are investing in carbon fiber technologies to meet both performance and environmental standards, reflecting a shift towards sustainable manufacturing.

Latin America

- Brazil is exploring the use of carbon fiber composites in its automotive industry, supported by government programs aimed at enhancing local manufacturing capabilities.

- Emerging automotive startups in Latin America are increasingly adopting carbon fiber materials to differentiate their products in a competitive market, reflecting a growing trend towards innovation.

North America

- The U.S. Department of Energy has launched initiatives to promote the use of lightweight materials in automotive manufacturing, which is expected to boost the adoption of carbon fiber composites in the region.

- Major automotive players like Ford and General Motors are investing in research and development for carbon fiber applications, focusing on enhancing vehicle performance and sustainability.

Middle East And Africa

- The UAE is investing in advanced manufacturing technologies, including carbon fiber composites, as part of its Vision 2021 initiative to diversify its economy and modernize its automotive sector.

- Local automotive manufacturers are beginning to collaborate with international firms to integrate carbon fiber into their production processes, aiming to improve vehicle performance and reduce weight.

Did You Know?

“Carbon fiber composites can be up to five times stronger than steel while being significantly lighter, making them an ideal choice for enhancing vehicle performance.” — American Composites Manufacturers Association

Segmental Market Size

The Automotive Carbon Fibre Composites market is playing a critical role in the automobile industry, mainly due to the lightweight properties that enhance fuel efficiency and performance. In the current scenario, this market is mainly driven by the growing demand for high-performance vehicles and stringent government regulations on carbon emissions. The emergence of electric vehicles, which require lightweight materials for maximum battery efficiency, is also driving the market. In addition, the cost of carbon fiber composites is reducing. The carbon fiber composites market is currently in the mass-production stage, with BMW and Audi leading the way in introducing these materials into their vehicles. The key areas of application are structural components, body panels, and interiors, where weight reduction is critical. In the future, as the trend towards sustainable development and stringent government regulations for lower carbon emissions grows, the use of carbon fiber composites is likely to increase. The future of this market is being shaped by the use of automation and resin transfer molding.

Future Outlook

The market for carbon-fibre composites in the field of automobiles is to increase from about 21 billion to 33,9 billion by 2032, which means a compound annual growth rate (CAGR) of 6.4%. This increase is due to the increasing demand for lightweight construction materials in the automobile industry, which improves fuel efficiency and reduces emissions. Especially in Europe and North America, where the framework conditions are becoming increasingly strict, automakers are increasingly turning to carbon-fibre composites in order to meet the stricter regulatory requirements and the increasing consumer demand for a sustainable approach. The market penetration of carbon-fibre composites in high-performance vehicles is expected to increase from 8% to more than 15% by 2032. This shows a strong shift towards advanced materials in the automobile industry. The penetration of carbon-fibre composites will be further increased by technological developments such as improved manufacturing processes and cost reductions in the carbon-fibre production. Likewise, the development of bio-based carbon fibres and the development of new methods for the recovery of carbon fibres will contribute to the increased sustainable character of carbon-fibre composites, which will make them more attractive for manufacturers and consumers. Also, the development of electric and driverless vehicles will lead to new opportunities for carbon-fibre composites, as these vehicles require lightweight constructions to optimize performance and range. In general, the market for carbon-fibre composites in the automobile industry is to grow rapidly.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD XX Billion |

| Growth Rate | 6.4% (2023-2032)Base Year2022Market Forecast Period2023-2032Historical Data2018- 2022Market Forecast UnitsValue (USD Billion)Report CoverageRevenue Forecast, Market Competitive Landscape, Growth Factors, and TrendsSegments CoveredProduction Type, ApplicationGeographies CoveredNorth America, Europe, Asia Pacific, and the Rest of the WorldCountries CoveredThe US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and BrazilKey Companies ProfiledCytec Industries (U.S.), SGL Carbon SE (Germany), Toray Industries, Inc. (Japan), ACP Composites, Inc (U.S.), Clearwater Composites, LLC (U.S.), Owens Corning (U.S.), HITCO Carbon Composites Inc (U.S.), Mitsubishi Rayon Carbon Fiber and Composites, Inc. (U.S.), Polar Manufacturing Limited (U.K.) and Rock West Composites (U.S.)Key Market OpportunitiesIncrease in vehicle production along with emission norms, as well as adoption of new technologiesKey Market DynamicsGrowing demand for carbon fiber-reinforced plastics in luxury cars, race cars and other high-performance cars |

Automotive Carbon Fiber Composites Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.