Focus on Enhanced Safety Features

The Automotive Body Mounts Market is also shaped by the growing emphasis on safety features in vehicles. As consumers become more safety-conscious, automakers are integrating advanced safety technologies into their designs. Body mounts are crucial in ensuring that these safety features function effectively, as they help maintain the structural integrity of the vehicle during collisions. The market for automotive safety systems is projected to grow significantly, with estimates suggesting it could reach USD 50 billion by 2027. This focus on safety is likely to drive demand for high-quality body mounts that can withstand rigorous safety standards.

Regulatory Compliance and Standards

The Automotive Body Mounts Market is influenced by stringent regulatory compliance and standards imposed by governments worldwide. These regulations often mandate specific performance criteria for vehicle components, including body mounts, to ensure safety and environmental sustainability. As regulations evolve, manufacturers are compelled to innovate and adapt their products to meet these standards. This compliance not only enhances the safety and reliability of vehicles but also drives the demand for advanced body mount solutions. The market is expected to see a shift towards products that not only comply with existing regulations but also anticipate future standards, thereby fostering growth in the Automotive Body Mounts Market.

Increased Vehicle Production and Sales

The Automotive Body Mounts Market is closely tied to the overall production and sales of vehicles. With the automotive sector witnessing a resurgence in production levels, the demand for body mounts is expected to rise correspondingly. In 2025, vehicle production is anticipated to reach approximately 90 million units, which will directly impact the body mounts market. This increase is driven by consumer preferences for new models and technological advancements in vehicle design. Consequently, manufacturers are likely to ramp up production to meet this demand, further stimulating growth in the Automotive Body Mounts Market.

Rising Demand for Lightweight Vehicles

The Automotive Body Mounts Market is significantly influenced by the rising demand for lightweight vehicles. As automakers strive to enhance fuel efficiency and reduce emissions, the need for lighter components becomes paramount. Body mounts play a critical role in achieving this objective, as they are essential for securing the vehicle's body to its frame while minimizing weight. The market for lightweight automotive components is expected to reach USD 100 billion by 2026, indicating a robust growth trajectory. This trend is likely to propel the demand for innovative body mount solutions that align with the automotive industry's sustainability goals.

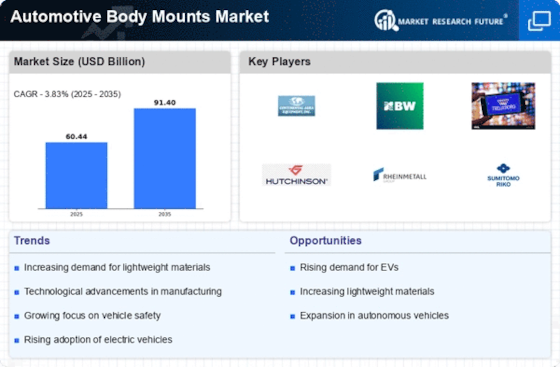

Technological Advancements in Automotive Body Mounts

The Automotive Body Mounts Market is experiencing a surge in technological advancements, particularly in materials and manufacturing processes. Innovations such as the use of advanced polymers and composites are enhancing the performance and durability of body mounts. These materials not only provide better vibration dampening but also contribute to weight reduction, which is crucial for fuel efficiency. As manufacturers increasingly adopt these technologies, the market is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is driven by the automotive industry's need for improved performance and the rising demand for lightweight vehicles.