Rising Consumer Awareness

Consumer awareness regarding vehicle maintenance and battery health is on the rise, which is likely to influence the Automotive Battery Tester Market positively. As vehicle owners become more informed about the importance of battery performance, they are increasingly seeking reliable testing solutions to ensure their vehicles operate efficiently. In 2025, it is estimated that approximately 60% of consumers will prioritize battery health checks during routine vehicle maintenance. This growing awareness is prompting automotive service providers to incorporate advanced battery testing equipment into their offerings, thereby expanding the Automotive Battery Tester Market. Furthermore, educational campaigns by manufacturers and service centers are expected to further enhance consumer knowledge, leading to increased demand for battery testing solutions.

Growth of Aftermarket Services

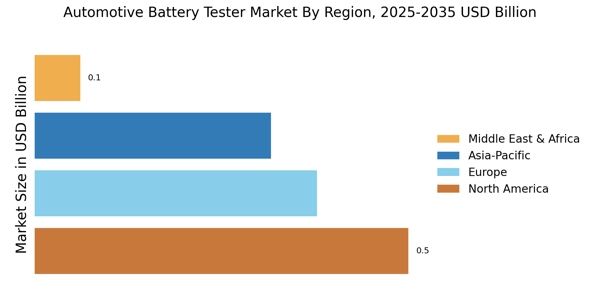

The expansion of aftermarket services in the automotive sector is poised to bolster the Automotive Battery Tester Market. As vehicle owners increasingly seek maintenance services beyond the original warranty period, the demand for battery testing solutions is expected to rise. In 2025, the aftermarket services sector is projected to account for over 40% of total automotive service revenue, highlighting the importance of battery health checks in routine maintenance. This trend is encouraging service providers to invest in advanced battery testing equipment to meet customer expectations. Additionally, the growth of independent repair shops and mobile service units is likely to further drive the demand for portable and efficient battery testing solutions, thereby enhancing the overall Automotive Battery Tester Market.

Increasing Vehicle Electrification

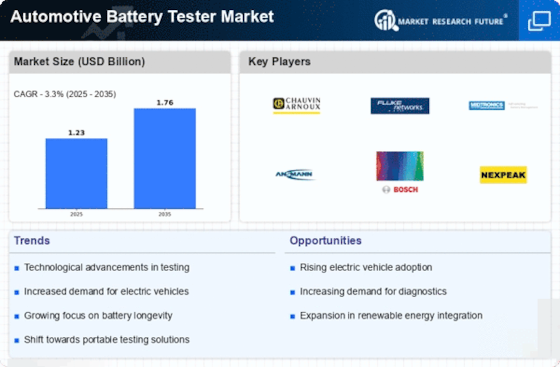

The automotive industry is witnessing a notable shift towards electrification, with electric vehicles (EVs) gaining traction. This trend is likely to drive the Automotive Battery Tester Market, as the demand for reliable battery testing solutions becomes paramount. As of 2025, the number of electric vehicles on the road is projected to surpass 30 million, necessitating advanced battery testing technologies to ensure optimal performance and safety. The Automotive Battery Tester Market must adapt to the unique requirements of EV batteries, which differ significantly from traditional lead-acid batteries. Consequently, manufacturers are investing in innovative testing solutions that cater to the specific needs of electric vehicle batteries, thereby enhancing the overall market landscape.

Regulatory Compliance and Standards

The automotive sector is subject to stringent regulations and standards concerning battery safety and performance. Compliance with these regulations is crucial for manufacturers and service providers, thereby driving the demand for reliable battery testing solutions within the Automotive Battery Tester Market. As of 2025, it is anticipated that new regulations will be introduced, focusing on battery recycling and environmental impact, further emphasizing the need for effective testing equipment. Companies that invest in advanced testing technologies to meet these regulatory requirements are likely to gain a competitive edge in the market. This regulatory landscape not only influences product development but also encourages innovation within the Automotive Battery Tester Market, as stakeholders seek to align with evolving standards.

Technological Innovations in Testing Equipment

Technological advancements in battery testing equipment are significantly shaping the Automotive Battery Tester Market. Innovations such as smart battery testers, which utilize advanced algorithms and connectivity features, are becoming increasingly prevalent. These devices not only provide accurate assessments of battery health but also offer real-time data analytics, enabling users to make informed decisions regarding battery maintenance. As of 2025, the market for smart battery testers is projected to grow by over 25%, driven by the increasing adoption of digital solutions in automotive maintenance. This trend indicates a shift towards more sophisticated testing methodologies, which could enhance the overall efficiency and reliability of battery testing processes within the Automotive Battery Tester Market.