- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The automotive appearance chemicals market has been witnessing significant trends in recent years, driven by various factors influencing consumer preferences and industry dynamics. One prominent trend is the growing demand for eco-friendly and sustainable products. With increasing environmental awareness among consumers and stringent regulations, there has been a notable shift towards environmentally friendly appearance chemicals in the automotive sector. Manufacturers are investing in research and development to formulate products that are biodegradable, non-toxic, and have minimal environmental impact throughout their lifecycle.

Another noteworthy trend is the emphasis on advanced formulations and innovative technologies. As consumers become more discerning about the appearance and maintenance of their vehicles, there is a rising demand for high-performance appearance chemicals that offer superior protection and durability. Manufacturers are leveraging advancements in materials science and nanotechnology to develop products with enhanced properties such as water repellency, scratch resistance, and UV protection. Additionally, the integration of smart coatings and self-healing technologies is gaining traction, providing added convenience and longevity to automotive finishes.

This is expected to fuel demand for automotive appearance chemicals during the forecast period. Moreover, luxury passenger cars and sports vehicles are the major consumers of these chemicals.

Furthermore, the proliferation of electric vehicles (EVs) is influencing market trends in the automotive appearance chemicals sector. EVs are characterized by sleek designs and futuristic aesthetics, driving the need for specialized coatings and detailing products to maintain their unique appearance. Manufacturers are catering to this niche market segment by offering customized solutions tailored to the specific requirements of electric vehicles, including paint protection films, ceramic coatings, and interior surface treatments designed to complement their design ethos and performance attributes.

Additionally, the advent of autonomous vehicles is reshaping the landscape of the automotive appearance chemicals market. With the rise of self-driving technology, there is a growing focus on interior detailing and maintenance solutions tailored to the needs of autonomous vehicle occupants. From odor neutralizers and anti-bacterial coatings to stain-resistant fabrics and self-cleaning surfaces, manufacturers are innovating to address the evolving requirements of future mobility solutions and shared transportation platforms.

Moreover, shifting consumer lifestyles and preferences are driving changes in the distribution channels for automotive appearance chemicals. While traditional brick-and-mortar stores remain relevant, there is a notable surge in online sales channels and e-commerce platforms. Consumers are increasingly turning to online retailers for convenience, product variety, and competitive pricing. Consequently, manufacturers are expanding their digital presence and adopting omni-channel strategies to reach a wider audience and capitalize on the growing trend of online shopping for automotive care products.

Automotive Appearance Chemicals Market Highlights:

Global Automotive Appearance Chemicals Market Overview

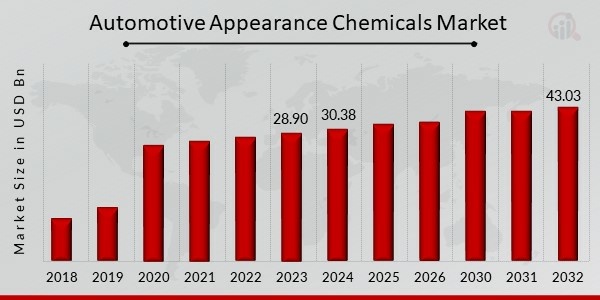

Automotive Appearance Chemicals Market Size was valued at USD 28.90 Billion in 2023. The automotive appearance chemicals industry is projected to grow from USD 30.38 Billion in 2024 to USD 43.03 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.45% during the forecast period (2024 - 2032). One of the key market drivers impacting the industry is the significant increase in car ownership brought on by expanding urbanization and rising disposable incomes.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Automotive Appearance Chemicals Market Trends

-

Rising sales of EV is driving the market growth

Due to increased environmental awareness and the necessity to meet future energy needs, the EV industry saw substantial development. The requirement for sustainable mobility significantly influences the demand for EV. Compared to the total number of EVs sold during the first half of 2018, around 1.1 million sold ly in the first half of 2019. This represents a 46% increase. Compared to the first half of 2018, the first half of 2019 saw a rise in EV sales of 22% in the US, 66% in China, and 35% in Europe. Around 2.1 million EVs were sold ly in 2018, up 64% of the units sold in 2017. The governments of several nations have enacted supportive policies for the use of electric vehicles and the development of the industry supporting them. The automotive appearance chemicals market is anticipated to increase as a result of rising energy costs and competition among innovative energy efficiency technologies. The market introduction of more EVs has been the subject of numerous plans and schedules from automakers in recent years. Toyota stated that by 2025, electric vehicles would account for half of its sales. Additionally, the business will collaborate with Chinese battery producers. By 2023, Volkswagen claims to have invested more than USD 30 billion in the development of EVs. By 2030, the firm wants 40% of its fleet to be electric vehicles. Thus, the automotive appearance chemicals market CAGR is anticipated to grow with the rise in electric vehicle sales.

Furthermore, the demand for rental automobiles is anticipated to rise during the forecast period due to the increasing travel and tourism industry growth. The automobile rental services will also be driven by the expanding urban population, who are also becoming more adventurous and interested in travel. Governments in both developed and emerging markets strongly emphasize reducing vehicle emissions and promoting car rentals as one of the most economical ways of transportation. The market for automotive appearance chemicals is expected to be driven by a number of other reasons, including the accessibility of these services through websites and mobile applications and the rising disposable income of people. Vehicle upkeep and servicing are key factors in determining rental rates as the car rental industry expands. The employment of AAACs to clean, safeguard, and fortify vehicle structures for end-use is expected to propel market expansion. Thus, driving the automotive appearance chemicals market revenue.

Automotive Appearance Chemicals Market Segment Insights

Automotive Appearance Chemicals Product Type Insights

The automotive appearance chemicals market segmentation, based on product type includes protectors, polishes and waxes, sealants, glass and wheel care. The polishes and waxes segment dominated the market. In order to restore shine to the car's surface as it begins to fade and lose gloss, waxes and polishes are applied. Waxes are applied to the surface to offer a layer of defense against small dings and scratches. They give the vehicle body gloss in addition to protecting the surface. Polishes remove incredibly thin layers of the topcoat protection and give the surface a level appearance. The flattened surface enables an even light reflection and gives automobiles a polished appearance.

Automotive Appearance Chemicals Vehicle Type Insights

The automotive appearance chemicals market segmentation, based on vehicle type, includes passenger cars, light commercial vehicles and heavy commercial vehicles. The passenger cars category generated the most income due to the growing demand for cars among the young population in nations like China and India. Demand has increased as a result of the items being used by all classes of vehicles, particularly luxury and antique vehicles.

Figure 1: Automotive Appearance Chemicals Market, by Distribution channel, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Automotive Appearance Chemicals Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The Asia Pacific automotive appearance chemicals market area will dominate this market. The number of young adults and people in the workforce who buy old cars is increasing in nations like China and India. The demand for automotive appearance chemicals in the cars application category is anticipated to increase over the forecast period due to the growing demand for automobiles. In addition, the demand for LCVs and HCVs is anticipated to increase due to the growing need for vehicles that can move commodities from one location to another.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: AUTOMOTIVE APPEARANCE CHEMICALS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe automotive appearance chemicals market accounts for the second-largest market share. Over the projected period, rising consumer demand for automotive appearance chemicals in nations like Germany is anticipated to fuel market expansion. Due to the extensive production of luxury and other types of passenger automobiles, the market for automotive appearance chemicals is growing in the area. Further, the German automotive appearance chemicals market held the largest market share, and the UK automotive appearance chemicals market was the fastest growing market in the European region

North America Automotive appearance chemicals Market is expected to grow at the fastest CAGR from 2023 to 2032. This is attributable to rising auto sales and drivers' desire to customize their automobiles. The rights of consumers to drive decorated, customized, and influential figures in the nation vigorously defend vintage vehicles. For anyone who appreciates automobiles and trucks to oppose proposed laws that would harm their passion and support legislation that is advantageous to vehicle fans, the Specialty Equipment Market Association (SEMA) keeps tabs on lawmakers in Washington, D.C., as well as each state in the USA. Moreover, US automotive appearance chemicals market held the largest market share, and the Canada automotive appearance chemicals market was the fastest growing market in the region.

Automotive Appearance Chemicals Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the automotive appearance chemicals market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, automotive appearance chemicals industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the automotive appearance chemicals industry to benefit clients and increase the market sector. In recent years, the automotive appearance chemicals industry has offered some of the most significant advantages to market. Major players in the automotive appearance chemicals market attempting to increase market demand by investing in research and development operations include 3M (US), The Dow Chemical Company (US), Meguiar's (US), Permatex (US), Malco Products Inc (US), Terra Silikon Teknolojileri ve Kimya (Turkey), Nuvite Chemical Compounds (US), General Chemical Corp (US) and Blue Ribbon Inc (US).

A material science corporation is Dow Inc (Dow). The Dow Chemical Co (TDCC), a completely owned subsidiary of the firm, manages its operations. The company's product line consists of silicones, industrial intermediates, coatings, silicones, and performance materials. Customers in the packaging, infrastructure, mobility, and consumer care categories can choose from a variety of the company's products and solutions. Home and personal care, durable goods, adhesives and sealants, coatings, food and specialty packaging are just a few industries where Dow's products are used.

Specialty chemicals have been provided by General Chemical Corp. since 1980 to help customers all over the world solve manufacturing-related issues. It specializes in: Paint strippers for various substrates, General Foundry Chemicals, Soldering Fluxes for Copper Brass Radiator Plants and Cast Strap Battery Plants, Lubricants for Metal Working Processes, Cleaners for Household and Industrial Uses, Specialty Protective Coatings for the Construction Industry and Paint/Spray Booth Maintenance Chemicals.

Key Companies in the automotive appearance chemicals market include

- 3M (US)

- The Dow Chemical Company (US)

- Meguiar's (US)

- Permatex (US)

- Malco Products Inc (US)

- Terra Silikon Teknolojileri ve Kimya (Turkey)

- Nuvite Chemical Compounds (US)

- General Chemical Corp (US)

- Blue Ribbon Inc (US)

Automotive Appearance Chemicals Industry Developments

May 2022: A well-known manufacturer of laminating solutions, Protect All Inc., offers the Biolam antimicrobial technology-based film, which is utilized in a number of applications, from packaged meals and menus to premium automotive protection films.

April 2020: Adam's Polishes, a leader in automotive cleaning and detailing products partnered with Microban, the market leader in antimicrobial technology, to increase the selection of antimicrobial solutions for cleaning car interiors.

Automotive Appearance Chemicals Market Segmentation

Automotive Appearance Chemicals Product Type Outlook (USD Billion, 2018-2032)

- Protectors

- Polishes and Waxes

- Sealants

- Glass and Wheel Care

Automotive Appearance Chemicals Vehicle Type Outlook (USD Billion, 2018-2032)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Appearance Chemicals Regional Outlook (USD Billion, 2018-2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.