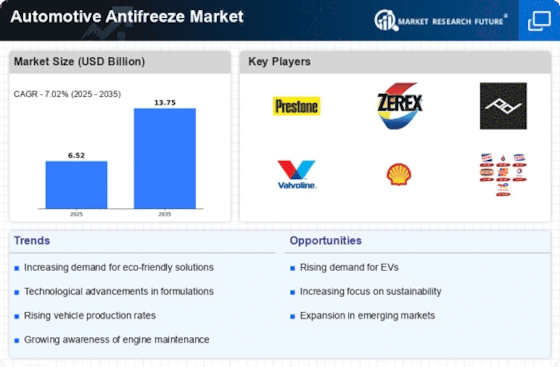

Rising Vehicle Production

The increasing production of vehicles is a primary driver for the Automotive Antifreeze Market. As manufacturers ramp up production to meet consumer demand, the need for antifreeze solutions becomes more pronounced. In recent years, vehicle production has shown a steady upward trend, with millions of units produced annually. This surge in production directly correlates with the rising demand for automotive antifreeze, as every vehicle requires effective cooling solutions to maintain optimal performance. The Automotive Antifreeze Market is likely to benefit from this trend, as manufacturers seek to ensure that their vehicles are equipped with high-quality antifreeze to prevent engine overheating and enhance longevity. Furthermore, the expansion of electric vehicles may also contribute to the growth of this market, as these vehicles still require effective thermal management systems.

Regulatory Standards and Compliance

The implementation of stringent regulatory standards regarding automotive fluids is a critical driver for the Automotive Antifreeze Market. Governments and environmental agencies are increasingly focusing on reducing the environmental impact of automotive products, including antifreeze. Regulations that mandate the use of less harmful chemicals and promote recycling of antifreeze products are influencing manufacturers to innovate and comply with these standards. As a result, the Automotive Antifreeze Market is witnessing a shift towards the development of eco-friendly antifreeze solutions that meet regulatory requirements. This compliance not only helps manufacturers avoid penalties but also appeals to environmentally conscious consumers. The ongoing evolution of regulatory frameworks is likely to continue shaping the market, pushing for advancements in antifreeze technology and formulation.

Increasing Vehicle Maintenance Awareness

The growing awareness regarding vehicle maintenance among consumers is a notable driver for the Automotive Antifreeze Market. As vehicle owners become more informed about the importance of regular maintenance, the demand for quality antifreeze products is expected to rise. This trend is particularly evident in regions where vehicle longevity and performance are prioritized. Consumers are increasingly recognizing that using high-quality antifreeze can prevent costly engine repairs and extend the lifespan of their vehicles. Consequently, the Automotive Antifreeze Market is likely to see a surge in demand as consumers actively seek out reliable antifreeze solutions as part of their vehicle maintenance routines. This heightened awareness may also lead to increased sales of antifreeze products during routine service intervals, further bolstering market growth.

Climate Change and Temperature Variability

The impact of climate change and increasing temperature variability is influencing the Automotive Antifreeze Market. As regions experience more extreme weather conditions, the need for reliable antifreeze solutions becomes critical. For instance, areas that face severe winters require antifreeze with lower freezing points to prevent engine damage. Conversely, regions with hotter climates necessitate antifreeze that can withstand higher temperatures without degrading. This variability in climate conditions drives consumers and manufacturers to seek advanced antifreeze formulations that can perform under diverse environmental stresses. The Automotive Antifreeze Market is thus positioned to grow as it adapts to these changing climate demands, offering products that cater to a wide range of temperature requirements and ensuring vehicle reliability across different climates.

Technological Innovations in Antifreeze Formulations

Technological advancements in antifreeze formulations are significantly shaping the Automotive Antifreeze Market. Innovations such as the development of long-life antifreeze and environmentally friendly options are gaining traction among consumers and manufacturers alike. These new formulations not only enhance performance but also reduce the environmental impact associated with traditional antifreeze products. For example, advancements in organic acid technology have led to the creation of antifreeze that lasts longer and provides superior protection against corrosion. As consumers become more environmentally conscious, the demand for these innovative products is likely to increase, driving growth in the Automotive Antifreeze Market. Manufacturers are thus compelled to invest in research and development to create cutting-edge antifreeze solutions that meet evolving consumer preferences and regulatory standards.