Growth of Electric and Hybrid Vehicles

The Automotive Anti-Vibration Mounting Market is significantly influenced by the growth of electric and hybrid vehicles. As the automotive landscape shifts towards electrification, the demand for specialized anti-vibration solutions tailored for electric drivetrains is on the rise. Electric vehicles (EVs) often require unique mounting solutions due to their different weight distribution and operational characteristics compared to traditional internal combustion engine vehicles. This shift is expected to drive the market for anti-vibration mounts, with projections indicating a potential increase in demand by over 6% in the next few years. Manufacturers are focusing on developing mounts that can effectively manage the vibrations produced by electric motors, thereby ensuring a smoother and quieter ride for consumers.

Rising Demand for Comfort and Noise Reduction

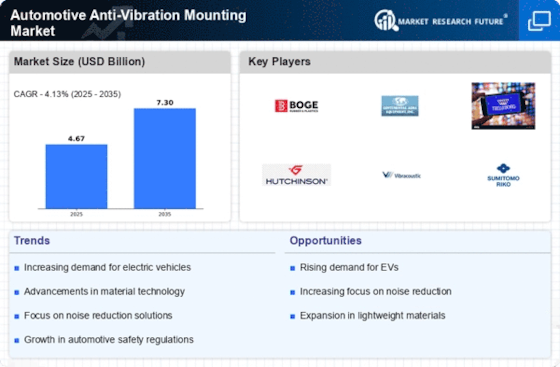

The Automotive Anti-Vibration Mounting Market is experiencing a notable increase in demand for enhanced comfort and noise reduction in vehicles. As consumers become more discerning regarding ride quality, manufacturers are compelled to integrate advanced anti-vibration technologies. This trend is particularly pronounced in luxury and high-performance vehicles, where the expectation for a smooth driving experience is paramount. According to recent data, the market for anti-vibration mounts is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is driven by the need for improved acoustic performance and the reduction of vibrations that can lead to driver fatigue and discomfort. Consequently, manufacturers are investing in innovative materials and designs to meet these evolving consumer preferences.

Technological Innovations in Mounting Solutions

Technological advancements play a crucial role in shaping the Automotive Anti-Vibration Mounting Market. Innovations such as the development of advanced elastomeric materials and the integration of smart technologies are enhancing the performance of anti-vibration mounts. These innovations not only improve the durability and effectiveness of the mounts but also contribute to weight reduction, which is increasingly important in the context of fuel efficiency and emissions regulations. The introduction of computer-aided design (CAD) and simulation tools has enabled manufacturers to optimize the design and functionality of these components. As a result, the market is witnessing a shift towards more sophisticated mounting solutions that can adapt to varying operational conditions, thereby improving vehicle performance and longevity.

Regulatory Compliance and Environmental Standards

The Automotive Anti-Vibration Mounting Market is also shaped by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing vehicle emissions and improving overall vehicle performance. These regulations often necessitate the use of advanced anti-vibration technologies to meet noise, vibration, and harshness (NVH) standards. As a result, manufacturers are compelled to innovate and enhance their product offerings to comply with these regulations. The market is expected to see a surge in demand for anti-vibration mounts that not only meet regulatory requirements but also contribute to the overall sustainability of vehicles. This trend is likely to drive investments in research and development, leading to the creation of more efficient and environmentally friendly mounting solutions.

Increasing Focus on Vehicle Safety and Performance

The Automotive Anti-Vibration Mounting Market is witnessing an increasing focus on vehicle safety and performance. As safety regulations become more stringent, manufacturers are prioritizing the development of anti-vibration solutions that enhance vehicle stability and control. Effective vibration management is critical for ensuring optimal performance, particularly in high-speed and off-road applications. The market is projected to grow as manufacturers recognize the importance of integrating advanced anti-vibration technologies into their designs. This focus on safety and performance is likely to lead to the adoption of innovative mounting solutions that not only reduce vibrations but also improve overall vehicle handling and driver confidence. Consequently, the market is expected to expand as consumers demand vehicles that offer both safety and superior performance.