Rising Consumer Demand for Comfort

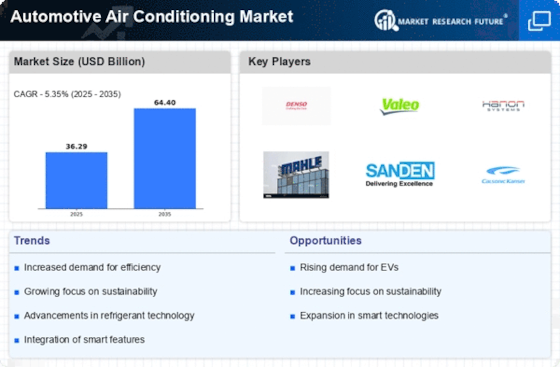

The Automotive Air Conditioning Market is experiencing a notable increase in consumer demand for enhanced comfort features in vehicles. As consumers prioritize comfort during their driving experience, the need for efficient and effective air conditioning systems becomes paramount. This trend is particularly evident in regions with extreme weather conditions, where air conditioning is not merely a luxury but a necessity. According to recent data, the demand for automotive air conditioning systems is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is driven by the increasing number of vehicles on the road and the rising expectations of consumers for advanced climate control systems. Consequently, manufacturers are compelled to innovate and improve their offerings to meet these evolving consumer preferences.

Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is a pivotal driver for the Automotive Air Conditioning Market. As the automotive landscape evolves, the demand for efficient air conditioning systems tailored for electric and hybrid models is increasing. These vehicles often require specialized HVAC systems that can operate effectively without compromising battery life. Market analysis suggests that the share of electric and hybrid vehicles in the overall automotive market is expected to grow significantly, potentially reaching 30% by 2030. This shift necessitates the development of innovative air conditioning solutions that are compatible with electric drivetrains. Consequently, manufacturers are focusing on creating lightweight, energy-efficient air conditioning systems that cater to the unique needs of these vehicles, thereby propelling the growth of the automotive air conditioning market.

Increasing Vehicle Production and Sales

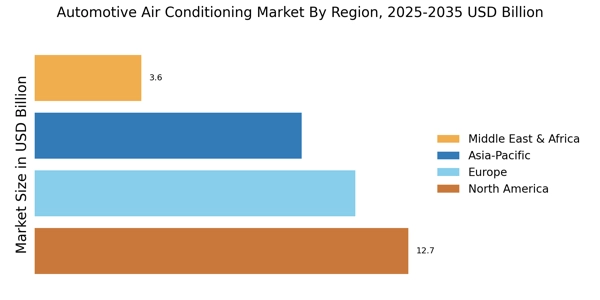

The Automotive Air Conditioning Market is closely linked to the increasing production and sales of vehicles worldwide. As automotive manufacturers ramp up production to meet rising consumer demand, the need for efficient air conditioning systems becomes more pronounced. Recent statistics indicate that vehicle production is projected to reach over 100 million units annually by 2026, which directly correlates with the demand for automotive air conditioning systems. This surge in production is driven by factors such as urbanization, rising disposable incomes, and a growing middle class in various regions. Consequently, manufacturers are compelled to enhance their air conditioning offerings to cater to a larger consumer base, thereby fostering growth in the automotive air conditioning market.

Technological Advancements in HVAC Systems

Technological advancements are significantly influencing the Automotive Air Conditioning Market. Innovations such as variable refrigerant flow systems, advanced climate control technologies, and energy-efficient components are reshaping the landscape of automotive HVAC systems. These advancements not only enhance the performance of air conditioning systems but also contribute to improved fuel efficiency and reduced emissions. For instance, the integration of electric compressors and smart sensors allows for more precise temperature control, which is increasingly appealing to environmentally conscious consumers. Market data indicates that the adoption of these technologies is expected to rise, with a projected increase in the market share of electric vehicle air conditioning systems. This shift towards more sustainable and efficient technologies is likely to drive growth in the automotive air conditioning sector.

Regulatory Standards and Environmental Concerns

The Automotive Air Conditioning Market is significantly impacted by regulatory standards and growing environmental concerns. Governments worldwide are implementing stringent regulations aimed at reducing greenhouse gas emissions and promoting the use of environmentally friendly refrigerants. The transition from traditional refrigerants to more sustainable alternatives, such as R-1234yf, is becoming increasingly common in the automotive sector. This shift is not only a response to regulatory pressures but also reflects a broader societal trend towards sustainability. As a result, manufacturers are investing in research and development to create air conditioning systems that comply with these regulations while maintaining performance. The market is expected to see a shift in consumer preferences towards vehicles equipped with eco-friendly air conditioning systems, further driving the growth of the industry.