Top Industry Leaders in the Automotive AHSS Market

*Disclaimer: List of key companies in no particular order

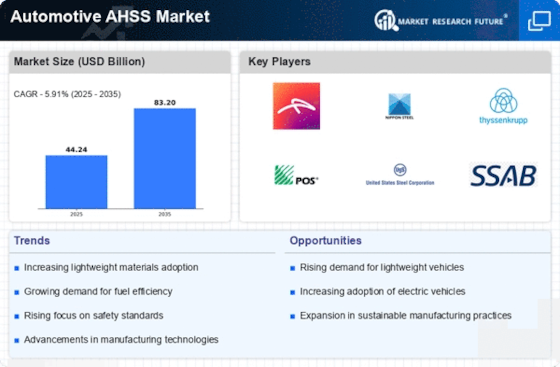

Top listed global companies in the Automotive AHSS industry are:

AK Steel Holding Corporation (U.S.)

ArcelorMittal S.A. (Luxembourg)

China Baowu Steel Group Corp Ltd. (China)

Kobe Steel Ltd.( Japan)

POSCO (South Korea)

SSAB AB (Sweden)

Tata Steel Limited(India)

ThyssenKrupp AG(Germany)

United Steel Corporation (India)

Bridging the Gap by Exploring the Competitive Landscape of the Automotive AHSS Top Players

The global automotive AHSS (Advanced High-Strength Steel) market growth is fueled by the relentless pursuit of lighter, safer, and more fuel-efficient vehicles. Understanding the competitive landscape within this dynamic market is crucial for both established players and new entrants.

Key Players and Strategies:

• Global Giants: Leading the pack are steel behemoths like ArcelorMittal, SSAB AB, POSCO, ThyssenKrupp AG, and United States Steel Corporation. These players leverage their extensive production capacities, research & development prowess, and established relationships with major automakers to maintain dominant market shares. Their strategies focus on:

o Product Expansion: Developing new AHSS grades with superior strength-to-weight ratios, formability, and weldability.

o Regional Expansion: Establishing production facilities closer to key growth markets, particularly in Asia-Pacific.

o Partnerships: Collaborating with automakers and research institutions to optimize AHSS applications and accelerate technology adoption.

• Rising Stars: Emerging players like Tata Steel, Nippon Steel & Sumitomo Metal Corporation, and China Steel Corporation are challenging the established order. Their advantages include:

o Cost Competitiveness: Lower production costs in regions like China and India enable them to offer competitive pricing.

o Focus on Niche Markets: Targeting specific segments like electric vehicles or lightweight commercial vehicles with tailored AHSS solutions.

o Vertical Integration: Expanding into downstream activities like stamping and forming to offer complete solutions to automakers.

Factors Influencing Market Share Analysis:

• Product Portfolio: The breadth and depth of AHSS grades offered, encompassing dual-phase steels, martensitic steels, and other high-performance grades.

• Production Capacity and Geographical Reach: Ability to cater to diverse regional demands and deliver just-in-time supplies.

• Technological Expertise: Continuous innovation in AHSS processing, coating, and joining technologies for enhanced performance and cost-effectiveness.

• Customer Relationships: Strong partnerships with automakers built on a foundation of technical support, co-development projects, and reliable supply chains.

• Sustainability Focus: Increasing adoption of greener steelmaking practices and offering AHSS grades with lower environmental impact.

Emerging Trends and Innovation:

• Third-Generation AHSS: Development of even lighter and stronger steel grades with superior crashworthiness and formability.

• Advanced Coatings: Development of corrosion-resistant and self-healing coatings to extend AHSS lifespan and reduce maintenance costs.

• Digitalization: Integration of artificial intelligence and big data analytics to optimize production processes, predict demand, and personalize AHSS solutions for specific vehicle models.

• Closed-Loop Recycling: Building efficient recycling infrastructure to recover end-of-life AHSS components and reduce reliance on virgin materials.

Overall Competitive Scenario:

The automotive AHSS market is characterized by intense competition, with both established players and new entrants vying for market share. Success hinges on continuous innovation, strategic partnerships, cost optimization, and responsiveness to evolving customer needs. While global giants hold a significant advantage, rising stars are constantly innovating and offering competitive solutions. The market is expected to remain dynamic, with technological advancements and regional growth patterns shaping the competitive landscape in the years to come.

Latest Company Updates:

October 26, 2023: Partnered with Ford to develop new lightweight AHSS for electric vehicles. (Source: Automotive News)

September 5, 2023: Collaborated with BMW on a research project to develop next-generation AHSS for crashworthiness. (Source: Kallanish Steel)

January 10, 2024: Unveiled a new high-strength, low-alloy (HSLA) steel specifically designed for automotive applications. (Source: China Daily)

November 22, 2023: Developed a new hot stamping process for AHSS, reducing production time and costs. (Source: Nikkei Asian Review)