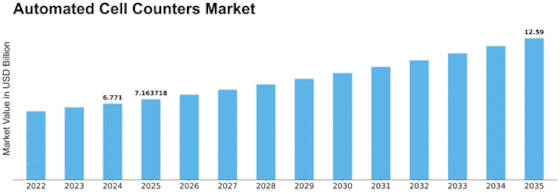

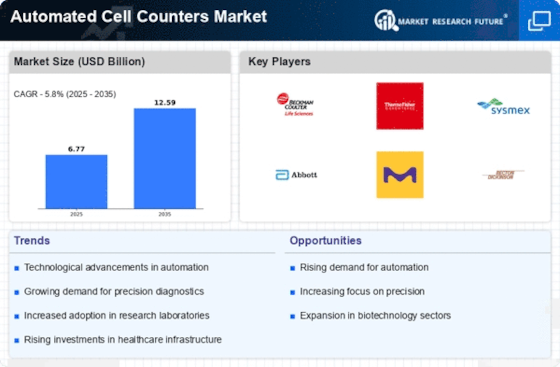

Automated Cell Counters Size

Automated Cell Counters Market Growth Projections and Opportunities

The Market for Automated Cell Counters has witnessed substantial growth in recent years, reflecting the increasing demand for efficient and accurate cell counting solutions across various research and clinical applications. Automated cell counters have become indispensable tools in laboratories, facilitating rapid and precise quantification of cells, thereby enhancing workflow efficiency. One of the key drivers of this market is the rising prevalence of diseases such as cancer and infectious diseases, prompting a surge in cell-based research and diagnostic activities.

These automated cell counters offer numerous advantages over traditional manual counting methods. They not only save time but also minimize the risk of human error, ensuring more reliable and reproducible results. The automation of cell counting processes is particularly beneficial in high-throughput applications, where large numbers of samples need to be analyzed quickly. Researchers and healthcare professionals are increasingly adopting automated cell counters to streamline their workflows and obtain more accurate data, contributing to the growth of the market.

The pharmaceutical and biotechnology industries are significant contributors to the demand for automated cell counters. These industries heavily rely on cell-based assays and research for drug discovery, development, and testing. The ability of automated cell counters to handle a wide range of cell types and deliver precise results makes them invaluable tools in these sectors. Moreover, the increasing investment in research and development activities by pharmaceutical companies further propels the market for automated cell counters.

In addition to their applications in research and drug development, automated cell counters play a crucial role in clinical diagnostics. The accurate quantification of cells is essential for various medical tests and treatments. As the prevalence of chronic diseases continues to rise, the demand for reliable diagnostic tools, including automated cell counters, is also on the ascent. These instruments find applications in areas such as hematology, oncology, and immunology, contributing to the expansion of their market.

Technological advancements have further fueled the growth of the Market for Automated Cell Counters. Manufacturers are continually innovating to introduce features like image-based cell counting, improved accuracy, and user-friendly interfaces. The integration of artificial intelligence and machine learning algorithms enhances the capabilities of these devices, allowing for more sophisticated analysis of cell populations. Such advancements not only improve the efficiency of cell counting but also open up new possibilities for in-depth cellular characterization.

Despite the positive trends, the market faces challenges, including the high initial cost of automated cell counters and the need for skilled personnel to operate these sophisticated instruments. However, as the technology continues to evolve, manufacturers are expected to address these challenges, making automated cell counters more accessible to a broader range of users.

Leave a Comment