Market Analysis

In-depth Analysis of Automated Cell Counters Market Industry Landscape

The market dynamics of automated cell counters reflect a rapidly evolving landscape driven by technological advancements, rising demand for efficient cell counting solutions, and a growing focus on research and development in life sciences. Automated cell counters play a pivotal role in various fields, including biotechnology, pharmaceuticals, and clinical diagnostics, offering a streamlined and accurate approach to cell counting compared to traditional manual methods.

One key driver influencing the automated cell counters market is the increasing prevalence of diseases and the subsequent demand for advanced diagnostic tools. As researchers and healthcare professionals seek more precise and efficient ways to analyze cell samples, the adoption of automated cell counters has witnessed a notable upswing. These instruments provide not only rapid results but also reduce the chances of human error, ensuring the reliability of cell counting data.

Technological innovations have been a major catalyst in shaping the market dynamics. The integration of artificial intelligence and machine learning algorithms into automated cell counting systems has significantly enhanced their capabilities. This allows for more sophisticated and accurate analysis of diverse cell types, paving the way for personalized medicine and tailored treatment approaches. Additionally, the development of high-throughput automated cell counters has addressed the need for processing large volumes of samples in a time-efficient manner, further fueling market growth.

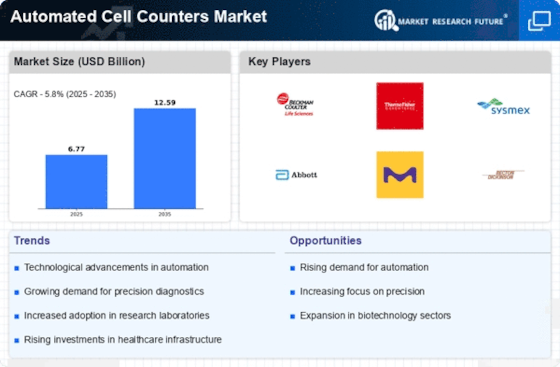

The competitive landscape of the automated cell counters market is characterized by the presence of established players and a surge in new entrants aiming to capitalize on the growing demand. Companies are actively investing in research and development to introduce innovative features, such as enhanced imaging technologies and connectivity options. This not only intensifies competition but also contributes to a continuous cycle of advancements, driving market expansion.

The pharmaceutical and biotechnology sectors are significant contributors to the demand for automated cell counters. These industries rely heavily on precise cell counting for various applications, including drug development, vaccine production, and bioprocessing. The need for standardized and reproducible results has led to a widespread adoption of automated cell counting solutions, creating a substantial market opportunity.

Moreover, the increasing focus on regenerative medicine and stem cell research has further propelled the demand for advanced cell counting technologies. Automated cell counters equipped with specialized algorithms for different cell types cater to the unique requirements of these cutting-edge fields. This expanding application scope broadens the market's horizons and presents manufacturers with lucrative prospects.

However, challenges such as the high initial cost of automated cell counters and the need for skilled personnel to operate these sophisticated instruments can potentially impede market growth. Addressing these challenges through strategic pricing models, user-friendly interfaces, and comprehensive training programs becomes crucial for market players to maximize their reach and impact.

Leave a Comment