Auto catalyst Market Summary

As per Market Research Future analysis, the Auto Catalyst Market Size was estimated at 13.67 USD Billion in 2024. The Auto Catalyst industry is projected to grow from 14.41 USD Billion in 2025 to 24.38 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Auto Catalyst Market is experiencing a transformative shift driven by regulatory pressures and evolving consumer preferences.

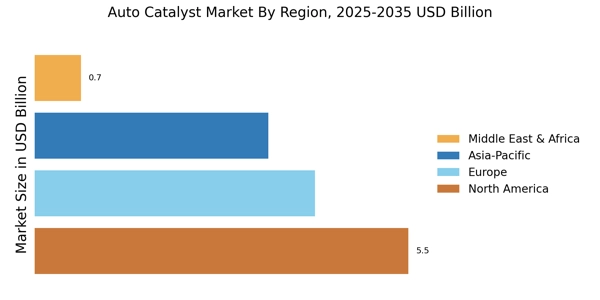

- North America remains the largest market for auto catalysts, driven by stringent emissions regulations.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing automotive production and demand.

- Light-duty vehicle gasoline segments dominate the market, while heavy-duty vehicles are witnessing rapid growth due to rising freight demands.

- Technological advancements and a heightened focus on sustainability are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 13.67 (USD Billion) |

| 2035 Market Size | 24.38 (USD Billion) |

| CAGR (2025 - 2035) | 5.4% |

Major Players

BASF (DE), Johnson Matthey (GB), Umicore (BE), Continental (DE), Nippon Yusen Kabushiki Kaisha (JP), Tenneco (US), Denso (JP), Aisin Seiki (JP), SABIC (SA)