- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

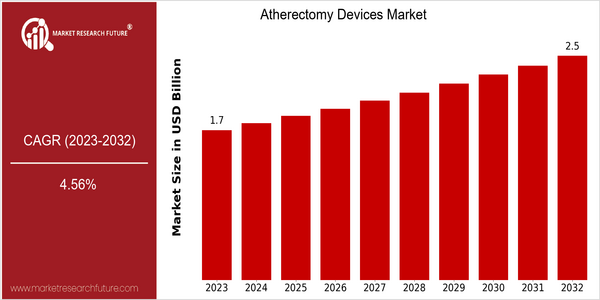

| Year | Value |

|---|---|

| 2023 | USD 1.67 Billion |

| 2032 | USD 2.5 Billion |

| CAGR (2024-2032) | 4.56 % |

Note – Market size depicts the revenue generated over the financial year

The atherectomy device market is expected to reach $ 2.50 billion by 2032, growing at a CAGR of 4.56% from 2024 to 2032. The steady increase in demand for atherectomy procedures is a result of the rising prevalence of cardiovascular diseases and the growing elderly population, which needs to have access to more advanced treatment methods. As the medical community increasingly adopts minimally invasive procedures, atherectomy devices are becoming increasingly common in interventional cardiology and peripheral vascular procedures. There are many factors driving this growth, including technological advances in device design and functionality that enhance procedure efficacy and patient outcomes. Laser and rotational atherectomy are gaining traction, offering more precise plaque removal. The major players in the market, such as Boston Scientific, Medtronic, and Cardiovascular Systems, are launching new products to take advantage of this growth. And the integration of digital health with atherectomy devices is expected to further enhance procedure success and patient monitoring, thereby contributing to the market growth.

Regional Market Size

Regional Deep Dive

The atherectomy devices market is experiencing significant growth across the globe, owing to the increasing prevalence of cardiovascular diseases and the advancements in medical technology. North America is characterized by the high adoption of atherectomy devices, which is attributed to the strong healthcare system and high investment in research and development. Europe has a varied regulatory framework, with varying rates of adoption, owing to the diverse health policies and reimbursement frameworks. The Asia-Pacific region is experiencing rapid growth, owing to the increasing healthcare expenditure and the growing geriatric population. The Middle East and Africa have low adoption rates, owing to the low availability of advanced medical technology. Latin America is slowly adopting atherectomy devices, owing to the increasing awareness and the improving healthcare system.

Europe

- The European Union's Medical Device Regulation (MDR) has introduced stricter compliance requirements, prompting manufacturers to enhance their product safety and efficacy, which is expected to lead to higher quality devices in the market.

- Organizations such as the European Society of Cardiology (ESC) are actively promoting awareness and education regarding the benefits of atherectomy, which is likely to increase adoption rates among healthcare providers.

Asia Pacific

- Countries like Japan and China are witnessing a surge in atherectomy device usage due to increasing incidences of cardiovascular diseases and a growing elderly population, leading to greater demand for minimally invasive procedures.

- Local companies, such as Japan's Terumo Corporation, are developing region-specific devices that cater to the unique anatomical and clinical needs of Asian patients, which is expected to enhance market penetration.

Latin America

- Brazil and Mexico are leading the way in atherectomy device adoption, driven by increasing healthcare access and awareness of cardiovascular diseases among the population.

- Collaborations between local healthcare providers and international device manufacturers are emerging, aimed at improving training and education on atherectomy procedures, which is expected to enhance procedural success rates.

North America

- The FDA has recently approved several new atherectomy devices, including the Diamondback 360® Orbital Atherectomy System, which is designed to treat calcified lesions more effectively, enhancing procedural outcomes.

- Key players like Medtronic and Boston Scientific are investing heavily in clinical trials and partnerships to expand their product offerings and improve patient outcomes, indicating a competitive landscape focused on innovation.

Middle East And Africa

- The Middle East is seeing increased investment in healthcare infrastructure, with governments in countries like the UAE and Saudi Arabia launching initiatives to improve cardiovascular care, thereby boosting the atherectomy devices market.

- Regulatory bodies in Africa are beginning to streamline the approval process for medical devices, which could facilitate faster market entry for innovative atherectomy technologies.

Did You Know?

“Atherectomy devices can remove plaque from arteries with minimal damage to surrounding tissue, making them a preferred choice for many interventional cardiologists.” — American College of Cardiology

Segmental Market Size

The Atherectomy Devices Market is currently growing steadily, driven by the rising prevalence of heart diseases and the growing demand for minimally invasive procedures. This demand is being driven by technological advancements in the field of catheters and the increasing focus on patient-centric care, which favors less invasive treatment methods. In addition, regulatory support, such as the approval of new atherectomy devices by the FDA, is boosting the market. The Atherectomy Devices Market is currently in its mature stage of development, with leading companies such as Boston Scientific and Medtronic leading the way in terms of product development and market penetration. North America and Europe are the leading markets for atherectomy devices, owing to the well-developed healthcare system and high patient awareness. The major applications of atherectomy devices are in the treatment of peripheral artery disease and in the treatment of stenosis of the coronary arteries. The devices Diamondback 360 and the Turbohawk are the leading products in these applications. The increasing focus on outpatient procedures and the technological advancements in the field of medical navigation and imaging are boosting the market. However, the growing emphasis on sustainable medical practices is influencing the future of atherectomy devices.

Future Outlook

OVERVIEW OF THE ATHHERECTOMY DEVICE MARKET: The arthroscopic device market is poised to grow at a CAGR of 4.56% from 2023 to 2032. This growth is attributed to the increasing prevalence of cardiovascular diseases, which is driving the demand for minimally invasive procedures. In addition, as the health care industry focuses on improving the patient outcome and recovery time, the adoption of atherectomy devices is expected to increase, especially in outpatient settings. In 2032, atherectomy procedures are expected to constitute approximately 15% of all peripheral artery interventions, up from an estimated 10% in 2023. This indicates a significant increase in the adoption of these devices in clinical practices. Furthermore, the development of next-generation atherectomy systems with improved precision and reduced procedure-related risks is expected to further drive the growth of this market. Also, supportive government policies to enhance access to cardiovascular care and increasing investments in the health care sector will create a favorable environment for market growth. In addition, emerging trends, such as the integration of digital health and telemedicine in the planning and follow-up of atherectomy procedures, will play a significant role in shaping the future of the market. In this backdrop, the atherectomy device market is expected to change and create new opportunities for both device manufacturers and health care providers.

Atherectomy Devices Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.