Increased Demand for Automation

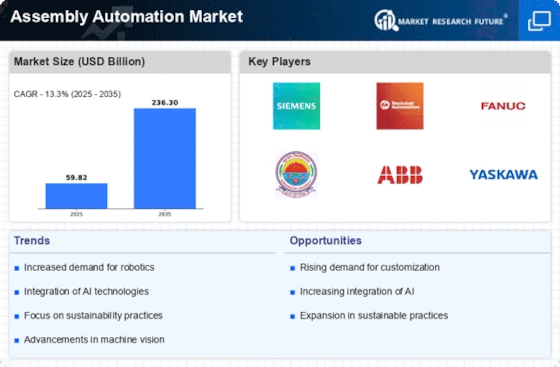

The Assembly Automation Market is experiencing a notable surge in demand for automation solutions across various sectors. Industries such as automotive, electronics, and consumer goods are increasingly adopting automated assembly processes to enhance productivity and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for higher efficiency and precision in manufacturing processes, which automated systems can provide. As companies strive to remain competitive, the integration of automation technologies becomes essential, thereby propelling the Assembly Automation Market forward.

Rising Focus on Quality Control

The rising focus on quality control is shaping the Assembly Automation Market in profound ways. As consumers demand higher quality products, manufacturers are compelled to implement stringent quality assurance processes. Automated assembly systems equipped with advanced inspection technologies can significantly enhance quality control measures, reducing defects and ensuring compliance with industry standards. This trend is particularly evident in sectors such as pharmaceuticals and electronics, where precision is paramount. The emphasis on quality is expected to drive the adoption of automation solutions, thereby fostering growth within the Assembly Automation Market.

Technological Advancements in Robotics

Technological advancements in robotics are significantly influencing the Assembly Automation Market. Innovations in robotic systems, such as improved sensors, artificial intelligence, and machine learning capabilities, are enabling more sophisticated and flexible automation solutions. These advancements allow robots to perform complex tasks with greater accuracy and adaptability, which is crucial for modern manufacturing environments. The market for industrial robots is expected to reach a valuation of over 70 billion dollars by 2026, indicating a robust growth trajectory. As manufacturers increasingly recognize the potential of advanced robotics, the Assembly Automation Market is likely to witness accelerated adoption of these technologies.

Labor Shortages and Workforce Challenges

Labor shortages and workforce challenges are emerging as critical drivers for the Assembly Automation Market. Many industries are facing difficulties in finding skilled labor, which has prompted companies to seek automation solutions to fill the gap. The need for a reliable and efficient workforce has never been more pressing, as businesses aim to maintain production levels and meet consumer demand. Automation not only addresses labor shortages but also enhances operational efficiency, allowing companies to optimize their resources. As a result, the Assembly Automation Market is likely to see increased investments in automated systems to mitigate workforce challenges.

Sustainability and Environmental Regulations

Sustainability and environmental regulations are increasingly influencing the Assembly Automation Market. As governments and organizations prioritize eco-friendly practices, manufacturers are compelled to adopt sustainable production methods. Automation plays a crucial role in this transition by optimizing resource usage and minimizing waste. The implementation of automated systems can lead to significant reductions in energy consumption and emissions, aligning with global sustainability goals. Furthermore, compliance with environmental regulations is becoming a critical factor for manufacturers, driving the need for automated solutions that support sustainable practices. This trend is likely to propel the Assembly Automation Market as companies seek to enhance their environmental performance.