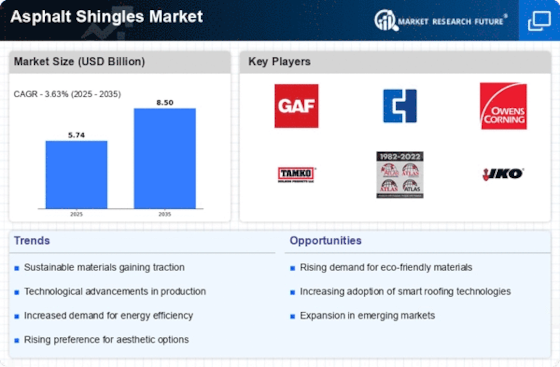

Rising Construction Activities

The Asphalt Shingles Market is experiencing a notable surge due to increasing construction activities across various sectors. As urbanization continues to expand, the demand for residential and commercial buildings rises, leading to a higher requirement for roofing materials. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which directly influences the Asphalt Shingles Market. This growth is driven by both new constructions and renovations, as homeowners seek durable and cost-effective roofing solutions. Furthermore, the trend towards energy-efficient buildings is likely to bolster the demand for asphalt shingles, which are known for their insulation properties. Consequently, the Asphalt Shingles Market stands to benefit significantly from these ongoing construction trends.

Growing Demand for Aesthetic Appeal

The Asphalt Shingles Market is increasingly influenced by consumer preferences for aesthetic appeal in roofing materials. Homeowners are now more inclined to choose roofing solutions that not only provide functionality but also enhance the visual appeal of their properties. In 2025, it is projected that the demand for architectural asphalt shingles, which offer a variety of colors and styles, will rise significantly. This trend is particularly evident in residential markets, where curb appeal is a key consideration for buyers. Manufacturers are responding to this demand by offering a wider range of designs and customization options. As a result, the Asphalt Shingles Market is likely to see a shift towards more visually appealing products, which could drive sales and market growth.

Increased Focus on Energy Efficiency

The Asphalt Shingles Market is witnessing a shift towards energy-efficient roofing solutions, as consumers and builders alike prioritize sustainability. Asphalt shingles, particularly those with reflective properties, are gaining traction due to their ability to reduce energy consumption in buildings. In 2025, it is estimated that energy-efficient roofing materials will account for over 30% of the total roofing market. This trend is further supported by government incentives and regulations aimed at promoting energy conservation. As a result, manufacturers in the Asphalt Shingles Market are increasingly investing in research and development to create products that meet these energy efficiency standards. This focus on sustainability not only enhances the appeal of asphalt shingles but also positions the industry favorably in a market that is progressively leaning towards eco-friendly solutions.

Technological Innovations in Manufacturing

Technological advancements are playing a crucial role in shaping the Asphalt Shingles Market. Innovations in manufacturing processes have led to the production of more durable and aesthetically pleasing shingles. For instance, the introduction of advanced polymer technology has improved the longevity and weather resistance of asphalt shingles. In 2025, it is anticipated that the market will see a rise in the adoption of smart roofing technologies, which integrate sensors to monitor roof conditions. These innovations not only enhance the performance of asphalt shingles but also provide added value to consumers. As manufacturers continue to embrace these technological advancements, the Asphalt Shingles Market is likely to experience increased competitiveness and growth, catering to the evolving needs of the construction sector.

Regulatory Support for Sustainable Materials

The Asphalt Shingles Market is benefiting from increasing regulatory support aimed at promoting sustainable building materials. Governments are implementing policies that encourage the use of environmentally friendly roofing solutions, which is likely to boost the demand for asphalt shingles. In 2025, it is expected that regulations will mandate higher standards for roofing materials, particularly in terms of recyclability and energy efficiency. This regulatory environment is pushing manufacturers to innovate and develop products that align with these standards. Consequently, the Asphalt Shingles Market is positioned to grow as it adapts to these changing regulations, ensuring that asphalt shingles remain a viable option for environmentally conscious consumers.