Government Initiatives and Support

Government initiatives and support are crucial drivers of growth within the Asia-Pacific Robotics Market. Many countries in the region are implementing policies aimed at promoting robotics research and development, as well as incentivizing businesses to adopt robotic technologies. For example, various governments are allocating substantial funding for robotics innovation hubs and research institutions, which are expected to foster collaboration between academia and industry. Additionally, tax incentives and grants for companies investing in automation technologies are becoming increasingly common. These supportive measures are likely to accelerate the adoption of robotics across sectors, contributing to a projected market growth rate of around 12% over the next few years. As a result, the Asia-Pacific Robotics Market stands to benefit significantly from enhanced governmental backing and strategic initiatives.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Asia-Pacific Robotics Market. Innovations in artificial intelligence, machine learning, and sensor technologies are driving the development of more sophisticated and capable robotic systems. These advancements enable robots to perform complex tasks with greater precision and adaptability, thereby expanding their applications across various industries. For instance, the integration of AI in robotics has led to the emergence of collaborative robots, or cobots, which can work alongside human operators safely and efficiently. The market for AI-driven robotics is expected to grow significantly, with estimates suggesting a potential increase of over 15% annually in the coming years. This technological evolution not only enhances the functionality of robots but also fosters a more dynamic and competitive landscape within the Asia-Pacific Robotics Market.

Growing Focus on Safety and Quality Control

The emphasis on safety and quality control is becoming increasingly pronounced within the Asia-Pacific Robotics Market. As industries strive to meet stringent regulatory standards and consumer expectations, the integration of robotics for quality assurance and safety monitoring is gaining traction. Robotics systems equipped with advanced sensors and imaging technologies can perform inspections and quality checks with a level of accuracy that surpasses human capabilities. This trend is particularly evident in sectors such as manufacturing and food processing, where compliance with safety regulations is paramount. The market for robotics focused on safety and quality control is anticipated to expand, with projections indicating a growth rate of approximately 9% annually. Consequently, the Asia-Pacific Robotics Market is likely to see a rise in demand for specialized robotic solutions that enhance product quality and ensure operational safety.

Rising Demand for Automation in Various Sectors

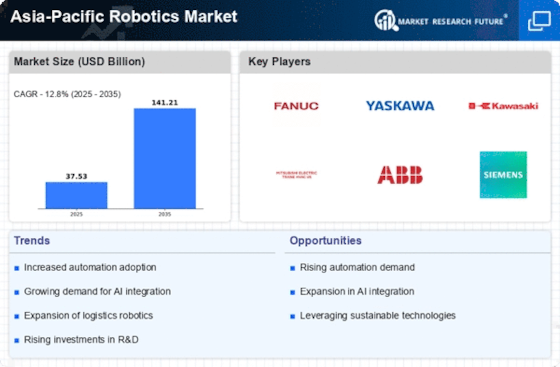

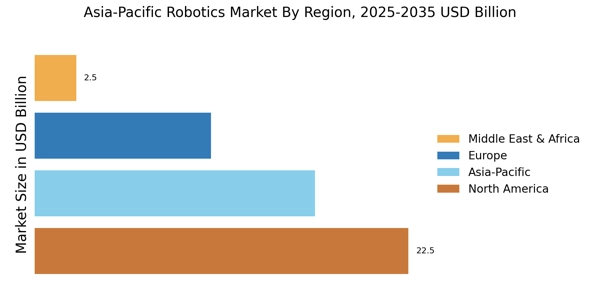

The Asia-Pacific Robotics Market experiences a notable surge in demand for automation across multiple sectors, including manufacturing, agriculture, and logistics. This trend is driven by the need for increased efficiency and productivity, as businesses seek to optimize operations and reduce labor costs. According to recent data, the automation market in Asia-Pacific is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is indicative of a broader shift towards integrating advanced robotics solutions into traditional workflows, thereby enhancing operational capabilities. As companies increasingly adopt robotic technologies, the Asia-Pacific Robotics Market is likely to witness significant advancements in automation technologies, leading to improved competitiveness and innovation in the region.

Increased Investment in Research and Development

Investment in research and development is a critical driver of innovation within the Asia-Pacific Robotics Market. Companies and research institutions are increasingly allocating resources to explore new robotic technologies and applications. This focus on R&D is essential for developing next-generation robotics that can address emerging challenges and opportunities in various sectors. Recent data suggests that R&D spending in the robotics sector is expected to increase by over 20% in the next few years, reflecting a strong commitment to advancing robotics capabilities. As a result, the Asia-Pacific Robotics Market is poised for transformative growth, with new products and solutions likely to emerge from these investments. This emphasis on innovation not only enhances the competitive landscape but also positions the region as a leader in the global robotics arena.