Top Industry Leaders in the Asia Pacific Power Generation Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Asia-Pacific Power Generation industry are:

Power Construction Corporation of China Ltd, National Thermal Power Corporation Limited, State Grid Corporation of China, Tokyo Electric Power Company Holdings, Korea Electric Power Corporation, China Huaneng Group Co., Ltd., China Huadian Corporation Ltd., Kansai Electric Power Co., Inc., Tata Power Company Ltd, and Chubu Electric Power Co., Inc.

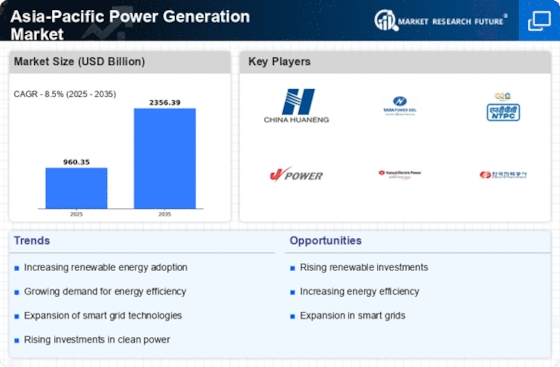

The Asia-Pacific power generation market, a behemoth poised for consistent growth, boasts a dynamic landscape teeming with established players and nimble newcomers. Understanding the strategies adopted, factors influencing market share, and emerging trends is crucial to navigate this complex arena.

Key Players and Their Strategies:

- State-Owned Giants: Power Construction Corporation of China (PowerChina), NTPC Limited (India), and State Grid Corporation of China (SGCC) dominate the scene with vast resources, government backing, and strong domestic footprints. Their strategies revolve around securing government contracts, leveraging economies of scale, and expanding into adjacent areas like transmission and distribution.

- International Conglomerates: Siemens, GE, Mitsubishi Hitachi Power Systems (MHPS) play a vital role through technology partnerships, equipment supply, and project financing. They focus on offering advanced, cleaner technologies like combined-cycle gas turbines and high-efficiency coal plants, capitalizing on the region's growing emphasis on environmental sustainability.

- Renewable Energy Champions: Leading the charge are companies like Sungrow Power Supply (China), Trina Solar (China), and Hanwha Qcells (Korea) who are scaling up renewable energy capacities across solar, wind, and hydro segments. Their strategies involve aggressive cost reduction, strategic partnerships, and securing lucrative feed-in tariffs offered by governments.

Market Share Analysis: Beyond Capacity Gigawatts:

While installed capacity (GW) remains a crucial metric, market share in the Asia-Pacific power generation market demands a more nuanced analysis. Factors like:

- Operation and Maintenance (O&M) expertise: Efficient plant operation and uptime play a vital role in cost optimization and grid stability. Players with robust O&M capabilities hold an edge.

- Fuel sourcing and logistics: Secure access to affordable fuel, especially for thermal plants, is critical. Companies with established fuel procurement networks and logistics muscle gain an advantage.

- Financial strength and access to capital: Large projects require substantial investments. Players with strong balance sheets and access to debt or equity financing have a clear advantage.

- Technology leadership and innovation: Offering cutting-edge technologies for cleaner and more efficient power generation attracts investments and secures market share.

Emerging Trends: Shaping the Future:

- Decarbonization Push: Stringent emission regulations and growing climate consciousness are driving a shift towards renewables. Companies are rapidly expanding their renewable energy portfolios and embracing hybrid solutions.

- Digitalization and Smart Grids: Integrating digital technologies like AI, IoT, and big data into grid management is optimizing operations, enhancing efficiency, and improving grid resilience. Companies with expertise in these areas are well-positioned to capitalize.

- Distributed Generation and Microgrids: Growing urbanization and demand for energy security are fueling the adoption of distributed generation and microgrids. Players offering modular and flexible solutions are gaining traction.

- Storage Solutions: The need for grid stability and managing the variability of renewables is boosting the demand for energy storage solutions. Companies investing in battery storage and pumped hydro technologies are creating new avenues for growth.

Overall Competitive Scenario: A Dynamic Balancing Act

The Asia-Pacific power generation market is undergoing a transformative phase. Established players face the challenge of adapting to the changing landscape, while new entrants exploit opportunities in renewables and disruptive technologies. Success hinges on navigating several critical factors:

- Flexibility and Adaptability: The ability to embrace new technologies, business models, and partnerships will be key to survival and growth.

- Sustainability Focus: Companies must demonstrate a commitment to cleaner energy solutions and carbon reduction to win favor with governments and investors.

- Innovation and Efficiency: Continuous R&D efforts and optimization of operations will be crucial to maintain competitiveness and secure market share.

- Strategic Partnerships and Collaborations: Forming alliances with technology providers, financial institutions, and governments will unlock new opportunities and accelerate growth.

The Asia-Pacific power generation market is a fiercely contested playground, with established giants battling against nimble newcomers and disruptive trends. Understanding the key players, their strategies, and the evolving landscape is vital for every stakeholder seeking to navigate this dynamic and lucrative arena.

Latest Company Updates:

National Thermal Power Corporation Limited (NTPC):

- October 2023: NTPC announces plans to invest $5 billion in renewable energy projects over the next five years.

- September 2023: NTPC commissions the first unit of its 2000 MW Darlipalli Super Thermal Power Project in India. (Source: NTPC website)

Power Construction Corporation of China Ltd (PowerChina):

- October 2023: PowerChina signs a contract to build a 100 MW solar power plant in Egypt.

- July 2023: PowerChina completes the construction of the world's largest pumped storage hydroelectric project, the Baihetan Hydropower Station. (Source: PowerChina website)

State Grid Corporation of China (SGCC):

- October 2023: SGCC wins a contract to build a smart grid project in Vietnam.

- August 2023: SGCC launches a new platform for carbon emission trading. (Source: SGCC website)

Tokyo Electric Power Company Holdings (TEPCO):

- October 2023: TEPCO announces plans to restart Unit 7 of the Kashiwazaki-Kariwa nuclear power plant.

- July 2023: TEPCO completes the decommissioning of Unit 1 of the Fukushima Daiichi nuclear power plant. (Source: TEPCO website)