Health and Safety Concerns

Health and safety concerns are increasingly influencing consumer choices within the Asia Pacific Paper Cups Market. The heightened awareness regarding hygiene, particularly in food and beverage consumption, has led to a preference for single-use paper cups over reusable options. In 2025, it is projected that the demand for disposable paper cups will rise by approximately 15%, as consumers prioritize safety and convenience. This trend is particularly evident in the wake of changing consumer behaviors, where individuals seek products that minimize contact and reduce the risk of contamination. Consequently, businesses are responding by offering paper cups that are not only safe but also designed to maintain the quality of beverages. This focus on health and safety is likely to continue driving the growth of the Asia Pacific Paper Cups Market, as consumers remain vigilant about their choices.

Sustainability Initiatives

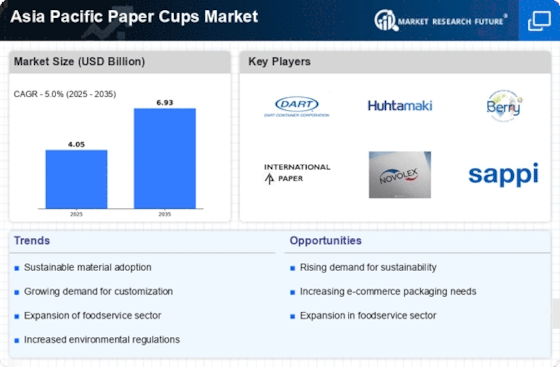

The Asia Pacific Paper Cups Market is experiencing a notable shift towards sustainability initiatives. Governments and organizations are increasingly advocating for eco-friendly products, which has led to a rise in the demand for paper cups made from renewable resources. In 2025, the market is projected to grow at a compound annual growth rate of approximately 5.2%, driven by consumer preferences for biodegradable and recyclable materials. This trend is further supported by regulatory measures aimed at reducing plastic waste, which have prompted businesses to adopt paper cups as a viable alternative. As a result, manufacturers are investing in sustainable practices, enhancing their product offerings to align with environmental standards. This focus on sustainability not only addresses ecological concerns but also appeals to a growing segment of environmentally conscious consumers, thereby bolstering the overall growth of the Asia Pacific Paper Cups Market.

Evolving Consumer Preferences

Evolving consumer preferences are a pivotal driver in the Asia Pacific Paper Cups Market. As consumers become more discerning, there is a growing demand for aesthetically pleasing and functional paper cups. In 2025, it is estimated that the market for premium paper cups will account for nearly 30% of total sales, reflecting a shift towards higher quality products. This trend is influenced by the rise of social media, where visually appealing packaging plays a crucial role in consumer engagement. Additionally, the increasing popularity of specialty beverages, such as artisanal coffees and craft teas, has led to a demand for unique and innovative cup designs. Manufacturers are responding by creating paper cups that not only serve a practical purpose but also enhance the overall consumer experience. This alignment with consumer preferences is expected to significantly contribute to the growth of the Asia Pacific Paper Cups Market.

Rise in Food and Beverage Sector

The Asia Pacific Paper Cups Market is significantly influenced by the expansion of the food and beverage sector. With the increasing number of cafes, restaurants, and food delivery services, the demand for disposable paper cups has surged. In 2025, the food service industry is expected to contribute substantially to the paper cups market, with an estimated market share of around 40%. This growth is attributed to the convenience offered by paper cups, which cater to the on-the-go lifestyle of consumers. Additionally, the rise in coffee consumption, particularly in urban areas, has further propelled the demand for paper cups. As businesses seek to enhance customer experience while maintaining hygiene standards, the reliance on disposable paper cups is likely to persist, thereby driving the growth of the Asia Pacific Paper Cups Market.

Technological Advancements in Production

Technological advancements in production processes are playing a crucial role in shaping the Asia Pacific Paper Cups Market. Innovations in manufacturing techniques, such as the use of automated machinery and improved paper coating technologies, have enhanced the efficiency and quality of paper cup production. In 2025, it is anticipated that these advancements will lead to a reduction in production costs by approximately 10%, making paper cups more accessible to a wider range of businesses. Furthermore, the introduction of digital printing technologies allows for customized designs, catering to the branding needs of companies. This flexibility in production not only meets consumer demands for personalization but also supports the growth of niche markets within the paper cups sector. As a result, technological progress is expected to be a key driver of growth in the Asia Pacific Paper Cups Market.