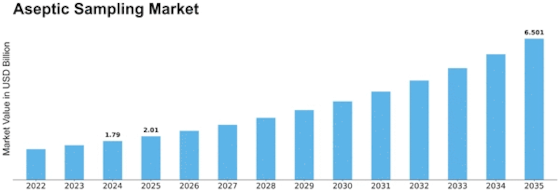

Aseptic Sampling Size

Aseptic Sampling Market Growth Projections and Opportunities

Growing Biotechnology and Pharmaceutical industries: The growing biotechnology and pharmaceutical industries have a big impact on the ASEPTIC SAMPLING market. As these sectors expand further in terms of R&D and manufacturing, there is an increasing need for aseptic sample solutions. Aseptic sampling is essential to preserving the quality of biotech and pharmaceutical products, which supports the expansion of the market. Strict Regulations: Strict regulatory requirements placed on sectors such food and beverage, pharmaceutical, and healthcare have a significant impact on market dynamics. Because aseptic sampling reduces the possibility of contamination during the sample procedure, it guarantees adherence to these criteria. The use of aseptic sampling methods is driven by the requirement to comply with regulatory rules, which in turn pushes market growth. Growing Customer Awareness of Product Safety: The ASEPTIC SAMPLING market is being driven by customers' growing awareness of product safety. End users and regulatory agencies both stress how crucial it is to keep products sterile and of high quality. This issue is addressed by aseptic sampling, which raises concerns about overall product safety and quality by lowering the possibility of contamination during the sampling process. technology Developments: Market trends are directly impacted by continuing technology developments in aseptic sampling methods and apparatus. Aseptic sampling procedures are more dependable and efficient because to advancements in equipment, materials, and sample techniques. Businesses that make research and development investments to stay on the cutting edge of technological advancements have a competitive advantage in the marketplace. Growing Emphasis on Research and Development: The market is impacted by the ongoing emphasis on R&D initiatives in a variety of sectors. The research process depends heavily on the use of precise and trustworthy sample methodologies. This need is met by aseptic sampling devices, which help the scientific community collect accurate and clean samples for their research. Growth in the Food and Beverage Sector: The ASEPTIC SAMPLING market is significantly influenced by the food and beverage sector. Manufacturers in this sector place a high priority on preserving the quality and safety of their products due to the growing demand for packaged and processed goods. In order to accomplish these goals and make sure that food and beverage items fulfill strict quality requirements, aseptic sampling is essential.

Leave a Comment