Enhanced DevOps Practices

The Application Container Market is significantly influenced by the evolution of DevOps practices. The integration of containers into DevOps workflows facilitates continuous integration and continuous deployment (CI/CD), thereby accelerating software development cycles. This shift is evidenced by a reported increase in the number of organizations implementing DevOps methodologies, with over 70% of companies indicating improved collaboration between development and operations teams. The Application Container Market benefits from this trend as containers provide a consistent environment for applications, reducing discrepancies between development and production. Consequently, organizations are likely to invest more in container technologies to enhance their DevOps capabilities.

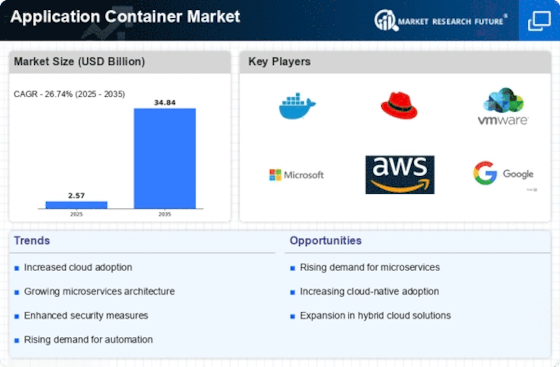

Rising Demand for Scalability

The Application Container Market experiences a notable surge in demand for scalability solutions. Organizations are increasingly adopting containerization to enhance their ability to scale applications seamlessly. This trend is driven by the need for businesses to respond swiftly to fluctuating workloads and user demands. According to recent data, the container orchestration market is projected to grow at a compound annual growth rate of over 25%, indicating a robust appetite for scalable solutions. As enterprises seek to optimize resource utilization and reduce operational costs, the Application Container Market is likely to witness a significant uptick in adoption rates, particularly among companies transitioning to cloud-native architectures.

Advancements in Container Security

The Application Container Market is significantly impacted by advancements in container security. As the adoption of containers increases, so does the emphasis on securing these environments. Recent studies indicate that security concerns are a top priority for over 80% of organizations utilizing container technologies. The development of robust security frameworks and tools tailored for containerized applications is essential for mitigating risks. The Application Container Market is expected to grow as companies invest in security solutions that address vulnerabilities specific to container environments, ensuring compliance and safeguarding sensitive data.

Growing Need for Hybrid Cloud Solutions

The Application Container Market is witnessing a growing need for hybrid cloud solutions. As organizations seek to leverage the benefits of both public and private clouds, containers offer a flexible approach to application deployment. This trend is underscored by data indicating that nearly 60% of enterprises are adopting hybrid cloud strategies to optimize their IT infrastructure. Containers enable seamless migration of applications across different environments, enhancing operational efficiency. The Application Container Market is poised for growth as businesses increasingly recognize the advantages of hybrid cloud architectures, which allow for greater agility and cost-effectiveness in application management.

Increased Focus on Application Portability

The Application Container Market is characterized by an increased focus on application portability. As organizations strive to avoid vendor lock-in and enhance flexibility, containers provide a solution that allows applications to run consistently across various environments. This trend is supported by findings that suggest over 50% of enterprises prioritize portability in their cloud strategies. The ability to move applications effortlessly between on-premises and cloud environments is becoming a critical factor for businesses. Consequently, the Application Container Market is likely to expand as organizations invest in technologies that facilitate application portability, ensuring they can adapt to changing business needs.