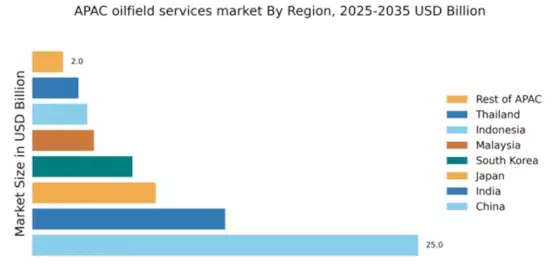

China : Robust Growth and Infrastructure Development

China holds a commanding 25.0% market share in the APAC oilfield services sector, valued at approximately $12 billion. Key growth drivers include increasing domestic oil production, government initiatives to enhance energy security, and significant investments in infrastructure. The demand for advanced drilling technologies and enhanced oil recovery methods is on the rise, supported by favorable regulatory policies aimed at attracting foreign investment and promoting sustainable practices.

India : Government Initiatives Fueling Growth

India accounts for 12.5% of the APAC oilfield services market, valued at around $6 billion. The sector is driven by government initiatives like the Hydrocarbon Exploration and Licensing Policy (HELP) and increasing energy demand. The consumption patterns are shifting towards cleaner energy sources, prompting investments in renewable technologies alongside traditional oilfield services. Regulatory support is enhancing exploration activities, particularly in offshore regions.

Japan : Focus on Innovation and Sustainability

Japan's oilfield services market holds an 8.0% share, valued at approximately $4 billion. The growth is propelled by technological advancements and a strong focus on sustainability. Demand for efficient drilling techniques and environmental compliance is rising, supported by government policies promoting energy efficiency. The market is also influenced by Japan's commitment to reducing carbon emissions, leading to investments in cleaner technologies.

South Korea : Strong Industrial Base and Innovation

South Korea represents 6.5% of the APAC market, valued at about $3.25 billion. The growth is driven by a robust industrial base and government support for energy diversification. Demand for advanced oilfield technologies is increasing, particularly in offshore drilling. The competitive landscape features major players like Samsung Heavy Industries and Hyundai Heavy Industries, which are investing in innovative solutions to enhance operational efficiency.

Malaysia : Investment in Exploration and Production

Malaysia's oilfield services market accounts for 4.0%, valued at approximately $2 billion. The sector is driven by investments in exploration and production, particularly in the deepwater regions of Sarawak and Sabah. Government initiatives to enhance local content and promote sustainable practices are shaping the market. Demand for integrated services is increasing, reflecting a shift towards more efficient operational models.

Thailand : Focus on Local Content and Sustainability

Thailand holds a 3.0% share of the APAC oilfield services market, valued at around $1.5 billion. The growth is supported by government policies aimed at increasing local content in oil and gas projects. Demand for oilfield services is rising, particularly in the Gulf of Thailand, where exploration activities are intensifying. The competitive landscape includes local firms and international players, fostering a dynamic business environment.

Indonesia : Diverse Resources and Investment Potential

Indonesia accounts for 3.57% of the APAC market, valued at approximately $1.8 billion. The sector is driven by diverse natural resources and increasing foreign investments in oil and gas exploration. Demand for oilfield services is growing, particularly in Sumatra and Kalimantan, where significant reserves are located. The competitive landscape features both local and international players, enhancing market dynamics and innovation.

Rest of APAC : Diverse Opportunities Across Regions

The Rest of APAC represents a 2.0% share of the oilfield services market, valued at around $1 billion. This segment includes emerging markets with unique opportunities driven by local resource availability and government support. Demand trends vary significantly, with some regions focusing on renewable energy integration alongside traditional oilfield services. The competitive landscape is characterized by smaller, agile firms adapting to local market needs.