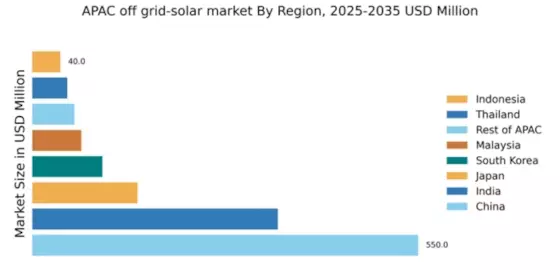

China : Leading in Renewable Energy Solutions

China holds a commanding market share of 55% in the APAC off-grid solar sector, valued at $550.0 million. Key growth drivers include government incentives for renewable energy, increasing energy demands in rural areas, and advancements in solar technology. The Chinese government has implemented policies to promote solar energy adoption, including subsidies and tax breaks, which have significantly boosted infrastructure development in both urban and rural settings.

India : Harnessing Solar for Rural Electrification

India accounts for 35% of the APAC off-grid solar market, valued at $350.0 million. The growth is driven by rising energy needs, particularly in rural areas, and government initiatives like the Pradhan Mantri Sahaj Bijli Har Ghar Yojana. Demand for off-grid solar solutions is increasing as households seek reliable electricity sources. The government is also focusing on enhancing solar infrastructure to meet its ambitious renewable energy targets.

Japan : Pioneering Technology in Solar Energy

Japan holds a 15% market share in the APAC off-grid solar market, valued at $150.0 million. The growth is fueled by technological advancements and a strong focus on energy independence post-Fukushima. Government policies support solar energy through feed-in tariffs and subsidies, encouraging both residential and commercial adoption. The demand for innovative solar solutions is rising, particularly in urban areas where space is limited.

South Korea : Advancing Towards Energy Independence

South Korea represents 10% of the APAC off-grid solar market, valued at $100.0 million. The market is driven by government initiatives aimed at reducing reliance on fossil fuels and promoting renewable energy. Policies such as the Renewable Energy 3020 Implementation Plan are pivotal in boosting solar adoption. The demand for off-grid solutions is growing, particularly in rural and island communities where grid access is limited.

Malaysia : Sustainable Energy for Development

Malaysia captures 7% of the APAC off-grid solar market, valued at $70.0 million. The growth is supported by government policies promoting renewable energy and increasing awareness of sustainability. Demand is particularly strong in rural areas where access to electricity is limited. The government has launched initiatives to enhance solar infrastructure, making it a key player in the region's renewable energy landscape.

Thailand : Boosting Rural Electrification Efforts

Thailand holds a 5% market share in the APAC off-grid solar market, valued at $50.0 million. The growth is driven by government policies aimed at increasing renewable energy usage and improving rural electrification. The demand for off-grid solar solutions is rising, particularly in remote areas. The government has introduced incentives to encourage solar adoption, fostering a competitive market environment.

Indonesia : Addressing Energy Access Challenges

Indonesia accounts for 4% of the APAC off-grid solar market, valued at $40.0 million. The market is driven by the need for energy access in remote areas and government initiatives promoting renewable energy. Demand for off-grid solar solutions is increasing as the government aims to electrify rural communities. The competitive landscape includes local and international players, focusing on affordable solar solutions.

Rest of APAC : Regional Variations in Solar Adoption

The Rest of APAC holds a 6% market share in the off-grid solar market, valued at $60.0 million. Growth is driven by varying energy needs across different countries and government policies supporting renewable energy. Demand trends vary, with some regions focusing on rural electrification while others emphasize urban solar solutions. The competitive landscape includes both local and international players, adapting to diverse market conditions.