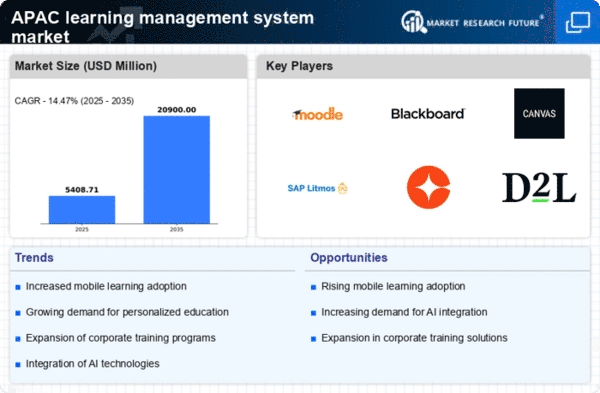

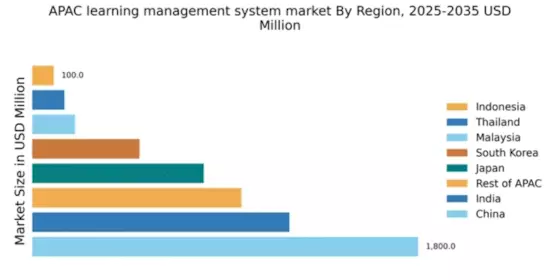

China : Unmatched Growth and Innovation

China holds a commanding market share of 36% in the APAC learning management system (LMS) sector, valued at $1800.0 million. Key growth drivers include rapid digital transformation, increased investment in education technology, and government initiatives promoting online learning. The demand for LMS is fueled by a growing emphasis on skill development and lifelong learning, supported by favorable regulatory policies and robust infrastructure development in urban areas.

India : Education Technology on the Rise

Key markets include metropolitan areas like Bengaluru, Delhi, and Mumbai, where tech startups and educational institutions thrive. The competitive landscape features major players like Moodle and Blackboard, alongside local startups. The business environment is dynamic, with a focus on skill development in sectors like IT and healthcare, driving the adoption of LMS solutions.

Japan : Tech-Driven Learning Environments

Tokyo and Osaka are pivotal markets, hosting numerous educational institutions and tech companies. The competitive landscape includes global players like Canvas and local firms. The business environment is characterized by a high demand for quality education, particularly in sectors like engineering and technology, leading to increased LMS adoption.

South Korea : Education Meets Technology

Seoul is a key market, with a concentration of educational institutions and technology firms. Major players like SAP Litmos and Cornerstone OnDemand have a significant presence. The competitive landscape is robust, with a focus on innovation and quality, particularly in sectors like language learning and vocational training.

Malaysia : Growth in Digital Education

Kuala Lumpur and Penang are key markets, with a growing number of educational institutions adopting LMS solutions. The competitive landscape includes both local and international players, with a focus on providing tailored solutions for diverse educational needs. The business environment is evolving, with a strong emphasis on skill development in sectors like finance and technology.

Thailand : Navigating Educational Transformation

Bangkok is a key market, with numerous universities and vocational institutions exploring LMS solutions. The competitive landscape features both local and international players, with a focus on providing affordable and accessible learning solutions. The business environment is gradually improving, with a growing emphasis on skill development in sectors like tourism and healthcare.

Indonesia : Potential for Growth and Innovation

Jakarta and Surabaya are key markets, with a growing number of educational institutions adopting LMS solutions. The competitive landscape includes both local startups and international players like Edmodo. The business environment is evolving, with a focus on improving educational access and quality, particularly in sectors like agriculture and technology.

Rest of APAC : Regional Variations in Adoption

Key markets include emerging economies in Southeast Asia and Pacific Island nations, where educational institutions are increasingly adopting LMS solutions. The competitive landscape is diverse, featuring both local and international players. The business environment varies significantly, with a focus on sector-specific applications in areas like vocational training and corporate education.