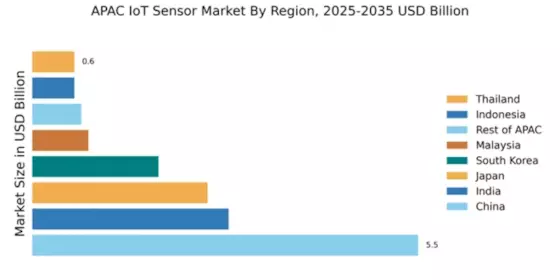

China : A Hub of Innovation and Growth

China holds a dominant market share of 5.5% in the APAC IoT sensor market, driven by rapid industrialization and urbanization. Key growth drivers include government initiatives like "Made in China 2025," which promotes advanced manufacturing technologies. The demand for IoT sensors is surging in sectors such as smart cities, healthcare, and manufacturing, supported by robust infrastructure development and favorable regulatory policies that encourage innovation and investment.

India : Rapid Growth in IoT Adoption

India's IoT sensor market accounts for 2.8% of the APAC total, reflecting a burgeoning demand driven by digital transformation across industries. Government initiatives like "Digital India" and "Make in India" are pivotal in fostering innovation. The increasing adoption of smart devices and automation in sectors such as agriculture, healthcare, and manufacturing is propelling market growth, alongside supportive regulatory frameworks that encourage foreign investment.

Japan : Innovation Meets Tradition

Japan's market share stands at 2.5%, characterized by a strong emphasis on R&D and technological advancement. The growth is fueled by the aging population, which drives demand for healthcare IoT solutions. Government policies promoting smart manufacturing and sustainability are also significant. The market is witnessing a shift towards automation and smart infrastructure, supported by a well-established industrial base and advanced technological capabilities.

South Korea : A Leader in Smart Solutions

South Korea holds a 1.8% share in the IoT sensor market, driven by its advanced technology landscape and government support for smart city projects. The demand for IoT sensors is growing in sectors like automotive, healthcare, and manufacturing. Initiatives such as the "K-Smart City" project are pivotal in enhancing urban infrastructure. The competitive landscape features major players like Samsung and LG, focusing on innovation and integration of IoT solutions.

Malaysia : Strategic Location for Innovation

Malaysia's IoT sensor market represents 0.8% of the APAC total, with growth driven by government initiatives like the "National IoT Strategic Roadmap." The demand is increasing in sectors such as agriculture, manufacturing, and smart cities. The government is actively promoting investment in IoT technologies, supported by a growing digital economy and infrastructure development. The market is characterized by a mix of local and international players.

Thailand : IoT Growth in Key Sectors

Thailand's market share is 0.6%, with growth fueled by the government's "Thailand 4.0" initiative, which emphasizes digital transformation. The demand for IoT sensors is rising in agriculture, manufacturing, and logistics. The competitive landscape includes both local startups and international firms, fostering innovation. Key cities like Bangkok and Chiang Mai are central to the IoT ecosystem, supported by favorable regulatory policies.

Indonesia : IoT Adoption on the Rise

Indonesia's IoT sensor market also accounts for 0.6%, driven by increasing smartphone penetration and digitalization across sectors. Government initiatives like "100 Smart Cities" are pivotal in promoting IoT adoption. The demand is particularly strong in agriculture, transportation, and smart city projects. The market is characterized by a mix of local and international players, with Jakarta being a key hub for innovation and investment.

Rest of APAC : Varied Growth Dynamics in APAC

The Rest of APAC holds a 0.7% market share, with diverse growth dynamics influenced by local economic conditions and government policies. Countries like Vietnam and the Philippines are emerging markets with increasing IoT adoption driven by digital transformation initiatives. The competitive landscape features a mix of local and global players, focusing on sector-specific applications in agriculture, healthcare, and manufacturing. Regulatory support is crucial for fostering innovation and investment.