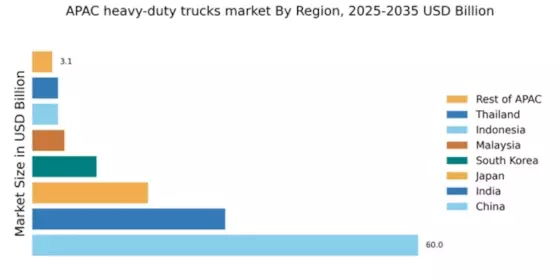

China : Unmatched Growth and Demand Trends

China holds a staggering 60.0% market share in the APAC heavy-duty truck sector, driven by rapid industrialization and urbanization. The government's push for infrastructure development, including the Belt and Road Initiative, has significantly boosted demand. Regulatory policies favoring eco-friendly vehicles are also shaping consumption patterns, with a noticeable shift towards electric and hybrid trucks. The robust manufacturing base and increasing logistics needs further enhance market growth.

India : Infrastructure Growth Fuels Demand

India commands a 30.0% share of the APAC heavy-duty truck market, with a value driven by increasing freight demand and infrastructure projects. The government's initiatives like the National Logistics Policy aim to streamline logistics and enhance road connectivity, fostering market growth. Additionally, the rise of e-commerce is propelling demand for heavy-duty trucks, particularly in urban areas, where consumption patterns are shifting towards faster delivery services.

Japan : Innovation Meets Demand in Japan

Japan's heavy-duty truck market holds an 18.0% share, characterized by a strong emphasis on technology and innovation. The market is driven by stringent emission regulations and a growing demand for fuel-efficient vehicles. Government initiatives promoting green technology and smart logistics are reshaping consumption patterns. The aging population is also influencing demand, as companies seek automated solutions to address labor shortages in logistics.

South Korea : Innovation and Quality Define South Korea

South Korea captures a 10.0% share of the heavy-duty truck market, bolstered by advanced manufacturing capabilities and a focus on quality. The government's support for green technology and infrastructure development is driving demand. Key cities like Seoul and Busan are major markets, with a competitive landscape featuring local players like Hyundai and international giants. The logistics sector, particularly e-commerce, is a significant driver of growth.

Malaysia : Strategic Location Boosts Logistics

Malaysia holds a 5.0% share in the heavy-duty truck market, benefiting from its strategic location in Southeast Asia. The government's initiatives to enhance road infrastructure and logistics networks are key growth drivers. Demand is rising in urban areas, particularly in Kuala Lumpur and Penang, where industrial activities are concentrated. The competitive landscape includes both local and international players, with a focus on cost-effective solutions for logistics.

Thailand : Strategic Growth in Southeast Asia

Thailand's heavy-duty truck market accounts for 4.0% of the APAC share, driven by its role as a logistics hub in Southeast Asia. The government's investment in infrastructure and transport networks is fostering growth. Key markets include Bangkok and Chonburi, where industrial activities are concentrated. The competitive landscape features both local manufacturers and international players, with a focus on meeting the demands of the logistics sector.

Indonesia : Infrastructure Development Fuels Growth

Indonesia represents 4.0% of the heavy-duty truck market in APAC, with growth driven by infrastructure development and increasing logistics needs. The government's focus on improving road networks and transportation systems is enhancing market dynamics. Key cities like Jakarta and Surabaya are pivotal markets, with a competitive landscape featuring both local and international manufacturers. The rise of e-commerce is also influencing demand patterns.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC accounts for 3.1% of the heavy-duty truck market, characterized by diverse economic conditions and regulatory environments. Growth is uneven, with some countries focusing on infrastructure development while others face challenges like regulatory hurdles. Key markets vary widely, with local players competing against international giants. The logistics and construction sectors are primary drivers of demand, influenced by regional economic conditions.