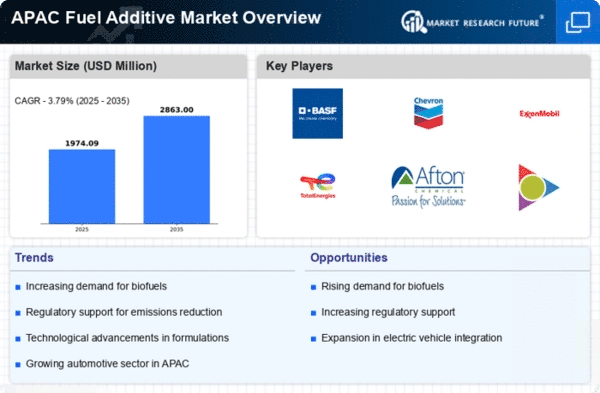

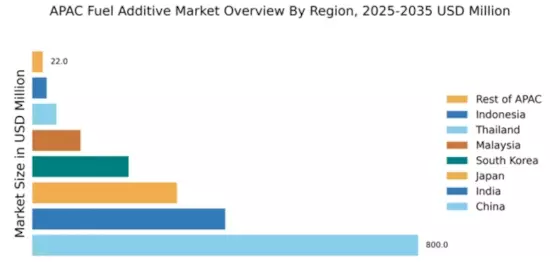

China : Robust Growth Driven by Demand

Key markets include major cities like Beijing, Shanghai, and Guangzhou, where industrial activities are concentrated. The competitive landscape features significant players such as BASF, ExxonMobil, and Afton Chemical, all vying for market share. Local dynamics are influenced by rapid urbanization and a growing automotive sector, with applications spanning automotive, marine, and industrial sectors. The business environment is favorable, supported by government incentives for innovation and sustainability.

India : Rapid Growth in Automotive Sector

Key markets include metropolitan areas such as Delhi, Mumbai, and Bangalore, where vehicle density is high. The competitive landscape features players like Chevron and TotalEnergies, who are establishing a strong foothold. Local market dynamics are characterized by a mix of domestic and international players, with a focus on automotive and industrial applications. The business environment is evolving, with increasing investments in R&D for innovative fuel solutions.

Japan : Focus on Innovation and Quality

Key markets include Tokyo, Osaka, and Nagoya, where automotive manufacturing is concentrated. The competitive landscape is dominated by major players like Innospec and Lubrizol, who are known for their innovative products. Local dynamics are influenced by consumer preferences for high-performance fuels, with applications primarily in the automotive and industrial sectors. The business environment is robust, supported by a strong focus on R&D and collaboration between industry and academia.

South Korea : Automotive Sector Driving Growth

Key markets include Seoul and Busan, where automotive manufacturing and consumption are high. The competitive landscape features players like BASF and Afton Chemical, who are actively expanding their presence. Local market dynamics are characterized by a focus on high-performance products, with applications in automotive and industrial sectors. The business environment is favorable, with increasing investments in sustainable technologies and innovation.

Malaysia : Strategic Location for Distribution

Key markets include Kuala Lumpur and Johor, where industrial activities are concentrated. The competitive landscape features both local and international players, including TotalEnergies and Clariant. Local dynamics are influenced by a diverse range of applications, from automotive to marine. The business environment is improving, supported by government policies encouraging foreign investment and innovation in fuel technologies.

Thailand : Focus on Automotive and Industrial Sectors

Key markets include Bangkok and Chonburi, where automotive manufacturing is concentrated. The competitive landscape features players like Chevron and Evonik, who are establishing a presence in the market. Local dynamics are characterized by a growing focus on high-performance products, with applications in automotive and industrial sectors. The business environment is evolving, with increasing investments in sustainable technologies and innovation.

Indonesia : Rising Demand for Fuel Efficiency

Key markets include Jakarta and Surabaya, where vehicle density is high. The competitive landscape features both local and international players, including ExxonMobil and Lubrizol. Local dynamics are influenced by a growing focus on fuel efficiency, with applications primarily in the automotive sector. The business environment is improving, supported by government policies encouraging investment in fuel technologies.

Rest of APAC : Diverse Applications Across Regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where demand for fuel additives is growing. The competitive landscape features a mix of local and international players, each catering to specific market needs. Local dynamics are characterized by varying consumer preferences and regulatory environments, with applications spanning multiple sectors. The business environment is evolving, with increasing interest in sustainable fuel solutions.