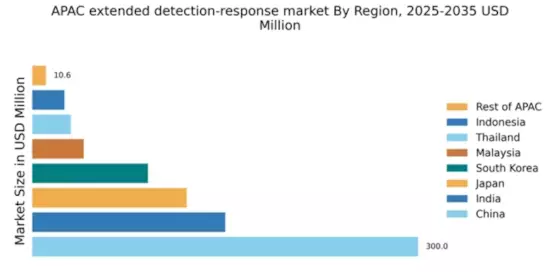

China : Unmatched Growth and Investment Opportunities

China holds a commanding market share of 300.0, representing a significant portion of the APAC extended detection-response market. Key growth drivers include rapid digital transformation, increasing cyber threats, and government initiatives promoting cybersecurity investments. The demand for advanced security solutions is rising, driven by the proliferation of IoT devices and cloud computing. Regulatory policies, such as the Cybersecurity Law, are fostering a robust framework for data protection and compliance, while substantial infrastructure investments are enhancing the overall cybersecurity ecosystem.

India : Emerging Market with High Potential

Key markets include major cities like Bengaluru, Hyderabad, and Mumbai, which are tech hubs attracting significant investments. The competitive landscape features major players like CrowdStrike and Microsoft, alongside local startups. The business environment is dynamic, with a focus on innovation and collaboration. Industries such as finance, healthcare, and e-commerce are increasingly adopting advanced cybersecurity measures to safeguard sensitive data.

Japan : Strong Focus on Cyber Resilience

Tokyo and Osaka are key markets, hosting numerous tech companies and startups focused on cybersecurity. The competitive landscape includes major players like Trend Micro and Palo Alto Networks, which have established a strong presence. The local market dynamics are characterized by a collaborative approach between government and industry, fostering innovation. Sectors such as automotive and healthcare are increasingly investing in cybersecurity to protect their digital assets.

South Korea : Government Support and Innovation

Seoul is a key market, with a concentration of technology firms and government agencies focused on cybersecurity. Major players like Cisco and McAfee have a significant presence, contributing to a competitive landscape. The local business environment is characterized by innovation and collaboration, with a focus on developing advanced cybersecurity technologies. Industries such as telecommunications and finance are prioritizing cybersecurity investments to safeguard their operations.

Malaysia : Emerging Market with Strong Potential

Kuala Lumpur is a key market, hosting numerous tech companies and startups focused on cybersecurity. The competitive landscape features both local and international players, with a focus on innovation and collaboration. The business environment is dynamic, with a growing emphasis on cybersecurity training and awareness programs. Industries such as e-commerce and telecommunications are increasingly investing in cybersecurity solutions to protect their digital assets.

Thailand : Government Initiatives Fuel Growth

Bangkok is a key market, with a concentration of businesses adopting cybersecurity measures. The competitive landscape includes both local and international players, with a focus on innovation and collaboration. The local business environment is characterized by a growing emphasis on cybersecurity training and awareness. Industries such as finance and retail are increasingly investing in cybersecurity solutions to safeguard their operations and customer data.

Indonesia : Growing Demand for Security Solutions

Jakarta is a key market, with a growing number of businesses adopting cybersecurity measures. The competitive landscape features both local and international players, with a focus on innovation and collaboration. The local business environment is dynamic, with a growing emphasis on cybersecurity training and awareness. Industries such as finance and e-commerce are increasingly investing in cybersecurity solutions to protect their digital assets and customer information.

Rest of APAC : Varied Market Dynamics and Challenges

Key markets include emerging economies in Southeast Asia and the Pacific Islands, each with unique cybersecurity challenges. The competitive landscape features a mix of local and international players, with a focus on innovation and collaboration. The local business environment is characterized by varying levels of cybersecurity awareness and investment. Industries such as finance, healthcare, and telecommunications are increasingly prioritizing cybersecurity to protect their operations and customer data.