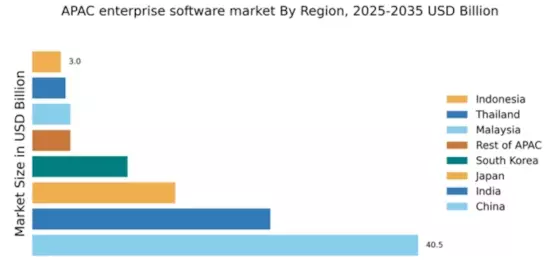

China : Unmatched Growth and Innovation

China holds a commanding 40.5% market share in the APAC enterprise software sector, valued at approximately $40 billion. Key growth drivers include rapid digital transformation, increased cloud adoption, and government initiatives promoting technology innovation. The demand for enterprise solutions is fueled by a burgeoning middle class and a shift towards smart manufacturing. Regulatory policies, such as the Cybersecurity Law, are shaping the landscape, while significant investments in infrastructure bolster industrial development.

India : A Booming Digital Economy

India's enterprise software market commands a 25% share, valued at around $25 billion. The growth is driven by a young, tech-savvy population and increasing investments in IT infrastructure. Demand trends show a shift towards cloud-based solutions and AI-driven applications. Government initiatives like Digital India are fostering a conducive environment for tech startups and innovation, while regulatory frameworks are evolving to support data protection and cybersecurity.

Japan : Strong Focus on Technology Integration

Japan holds a 15% market share in the enterprise software sector, valued at approximately $15 billion. The market is driven by a strong emphasis on automation and efficiency, particularly in manufacturing and logistics. Demand for advanced analytics and AI solutions is rising, supported by government policies promoting digital transformation. The aging population is also pushing companies to adopt technology to maintain productivity and competitiveness.

South Korea : A Leader in Digital Solutions

South Korea's enterprise software market accounts for 10% of the APAC share, valued at about $10 billion. The growth is propelled by high internet penetration and a robust startup ecosystem. Demand for cybersecurity solutions is increasing due to rising digital threats, while government initiatives support innovation in AI and big data. The competitive landscape features strong local players alongside global giants, creating a dynamic business environment.

Malaysia : Growth in Cloud Solutions

Malaysia's enterprise software market represents 4% of the APAC share, valued at around $4 billion. Key growth drivers include increasing cloud adoption and government support for digital transformation initiatives. Demand for software solutions is rising in sectors like finance and healthcare, driven by regulatory frameworks encouraging innovation. The government’s Malaysia Digital Economy Blueprint aims to enhance the digital landscape significantly.

Thailand : Focus on Digital Transformation

Thailand's enterprise software market holds a 3.5% share, valued at approximately $3.5 billion. The growth is driven by increasing investments in IT infrastructure and a push towards digitalization across various sectors. Government initiatives, such as the Thailand 4.0 policy, are fostering innovation and technology adoption. The competitive landscape includes both local and international players, with a focus on sectors like tourism and manufacturing.

Indonesia : A Growing Digital Landscape

Indonesia's enterprise software market accounts for 3% of the APAC share, valued at around $3 billion. The growth is driven by a young population and increasing smartphone penetration, leading to higher demand for digital solutions. Government initiatives promoting e-governance and digital economy are enhancing the business environment. Key cities like Jakarta and Surabaya are emerging as tech hubs, attracting investments from major players.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC holds a 4% market share in the enterprise software sector, valued at approximately $4 billion. Growth is driven by varying levels of digital adoption and government initiatives across different countries. Demand trends show a rise in cloud services and cybersecurity solutions. The competitive landscape features a mix of local and international players, with opportunities in sectors like education and healthcare.