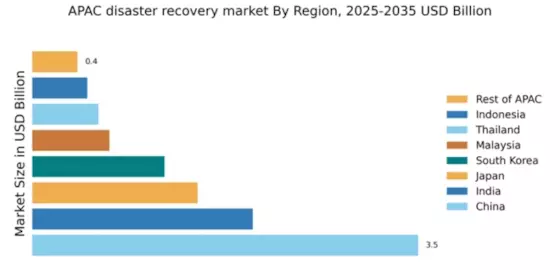

China : Robust Growth Driven by Innovation

China holds a commanding market share of 3.5% in the disaster recovery services sector, valued at approximately $1.5 billion. Key growth drivers include rapid digital transformation, increasing data security concerns, and government initiatives promoting cloud adoption. The demand for reliable disaster recovery solutions is surging, particularly in sectors like finance and healthcare, supported by regulatory frameworks that emphasize data protection and business continuity. Infrastructure development, especially in tier-1 cities, is further enhancing service delivery capabilities.

India : Rapid Growth in Digital Services

India's disaster recovery services market is valued at 2.0%, approximately $800 million, driven by the rapid adoption of cloud technologies and increasing awareness of data protection. The government’s Digital India initiative is a significant catalyst, encouraging businesses to invest in robust disaster recovery solutions. Demand is particularly high in IT, telecommunications, and e-commerce sectors, where data integrity is critical. Regulatory policies are evolving to support these trends, ensuring compliance and security.

Japan : Focus on Resilience and Innovation

Japan's market share stands at 1.5%, valued at around $600 million, reflecting a strong emphasis on technological innovation and resilience. The growth is driven by increasing natural disasters and a cultural focus on preparedness. Government initiatives, such as the Disaster Countermeasures Basic Act, promote investment in disaster recovery services. The demand is particularly pronounced in sectors like manufacturing and finance, where operational continuity is paramount, supported by advanced infrastructure.

South Korea : Strong Infrastructure and Investment

South Korea holds a market share of 1.2%, valued at approximately $500 million, with growth fueled by significant investments in IT infrastructure and cloud services. The government’s support for digital transformation initiatives is a key driver, alongside increasing cyber threats. Major cities like Seoul and Busan are central to this market, hosting numerous data centers. The competitive landscape features strong players like IBM and Microsoft, focusing on sectors such as finance and healthcare.

Malaysia : Investment in Digital Infrastructure

Malaysia's disaster recovery services market is valued at 0.7%, approximately $300 million, with growth driven by increasing digitalization and government initiatives like the Malaysia Digital Economy Blueprint. The demand for disaster recovery solutions is rising in sectors such as finance and telecommunications, where data security is critical. The competitive landscape includes local and international players, with Kuala Lumpur emerging as a key market hub.

Thailand : Focus on Business Continuity Planning

Thailand's market share is 0.6%, valued at around $250 million, with growth driven by increasing awareness of business continuity planning and disaster recovery. Government initiatives aimed at enhancing digital infrastructure are pivotal, particularly in sectors like tourism and manufacturing. Bangkok is a key market, with a growing number of service providers entering the space, including both local firms and international players like Dell Technologies.

Indonesia : Rising Awareness and Investment

Indonesia's disaster recovery services market is valued at 0.5%, approximately $200 million, with growth driven by increasing digital adoption and awareness of data protection. Government initiatives to enhance digital infrastructure are crucial, particularly in sectors like e-commerce and finance. Jakarta is a central market, with a competitive landscape featuring both local and international players, focusing on tailored solutions for various industries.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a market share of 0.41%, valued at around $150 million, with diverse growth driven by varying levels of digital adoption and regulatory environments. Countries in this category are increasingly recognizing the importance of disaster recovery services, influenced by local market dynamics. The competitive landscape includes a mix of regional players and global firms, catering to specific sector needs, particularly in finance and healthcare.