Rising Demand for Energy Storage Solutions

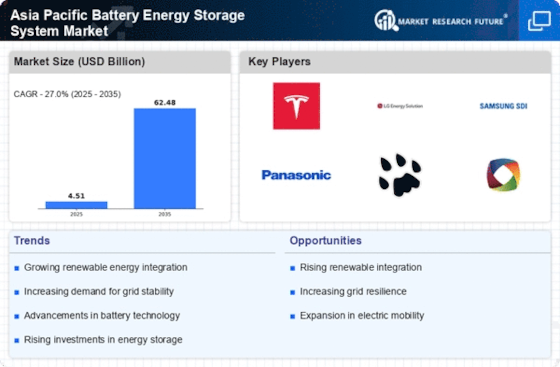

The Asia Pacific Battery Energy Storage System Market is experiencing a notable surge in demand for energy storage solutions. This trend is primarily driven by the increasing need for grid stability and reliability, particularly in countries with high renewable energy penetration. As renewable sources like solar and wind become more prevalent, the ability to store excess energy for later use becomes crucial. According to recent data, the energy storage capacity in the region is projected to reach approximately 30 GW by 2025, reflecting a compound annual growth rate of around 20%. This growing demand for energy storage solutions is likely to propel the Asia Pacific Battery Energy Storage System Market forward, as stakeholders seek to enhance energy security and optimize resource utilization.

Technological Innovations in Energy Storage

Technological innovations are transforming the landscape of the Asia Pacific Battery Energy Storage System Market. Advances in battery technologies, such as lithium-ion and solid-state batteries, are enhancing energy density, efficiency, and lifespan, making energy storage systems more viable for a range of applications. These innovations are not only improving the performance of energy storage solutions but also reducing costs, thereby making them more accessible to consumers and businesses alike. As technology continues to evolve, the market is likely to witness a shift towards more sophisticated energy storage systems that can cater to diverse energy needs. The ongoing research and development efforts in battery technology suggest that the Asia Pacific Battery Energy Storage System Market will continue to grow, driven by the demand for more efficient and cost-effective energy storage solutions.

Government Initiatives and Policy Frameworks

Government initiatives and supportive policy frameworks play a pivotal role in shaping the Asia Pacific Battery Energy Storage System Market. Various governments in the region are implementing policies aimed at promoting energy storage technologies, which include financial incentives, subsidies, and regulatory frameworks that facilitate the deployment of battery storage systems. For instance, countries like Australia and Japan have introduced programs to encourage the adoption of energy storage solutions, thereby enhancing grid resilience and reducing reliance on fossil fuels. These initiatives are expected to drive investments in the battery energy storage sector, with projections indicating that the market could witness a growth rate of over 15% annually through 2025, underscoring the importance of government support in fostering market expansion.

Increased Investment in Renewable Energy Projects

The Asia Pacific Battery Energy Storage System Market is significantly influenced by the increased investment in renewable energy projects across the region. As nations strive to meet their energy transition goals, substantial capital is being allocated to solar, wind, and other renewable energy initiatives. This influx of investment not only enhances the generation capacity of renewables but also necessitates the integration of energy storage systems to manage intermittency and ensure a stable energy supply. Reports indicate that investments in renewable energy in Asia Pacific are expected to exceed USD 200 billion by 2025, creating a robust demand for battery energy storage solutions. Consequently, this trend is likely to bolster the Asia Pacific Battery Energy Storage System Market, as stakeholders recognize the critical role of storage in achieving energy sustainability.

Growing Awareness of Energy Efficiency and Sustainability

The growing awareness of energy efficiency and sustainability is a significant driver for the Asia Pacific Battery Energy Storage System Market. As environmental concerns gain prominence, both consumers and businesses are increasingly prioritizing sustainable energy practices. This shift in mindset is leading to a greater emphasis on energy storage solutions that can optimize energy use and reduce carbon footprints. Educational campaigns and advocacy for sustainable practices are further fueling this trend, encouraging the adoption of battery energy storage systems as a means to enhance energy efficiency. Market analyses indicate that the demand for sustainable energy solutions is expected to rise, with the battery storage market projected to grow at a rate of approximately 18% annually through 2025. This heightened awareness is likely to propel the Asia Pacific Battery Energy Storage System Market, as stakeholders seek to align with sustainability goals.