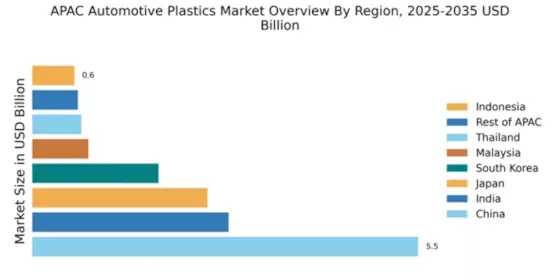

China : Unmatched Growth and Demand Trends

China holds a commanding 5.5% market share in the automotive plastics sector, driven by rapid industrialization and a booming automotive industry. Key growth drivers include increasing vehicle production, rising consumer demand for lightweight materials, and government initiatives promoting electric vehicles (EVs). Regulatory policies favoring sustainable materials further enhance market potential, while robust infrastructure development supports manufacturing capabilities.

India : Rapid Growth in Automotive Sector

India's automotive plastics market accounts for 2.8% of the APAC total, reflecting significant growth potential. The rise in disposable income, urbanization, and government initiatives like 'Make in India' are propelling demand. Additionally, the push for electric vehicles and lightweight materials is reshaping consumption patterns, supported by favorable regulatory frameworks and investments in infrastructure.

Japan : Technological Advancements Drive Growth

Japan's market share stands at 2.5%, characterized by a strong focus on innovation and technology. The automotive sector is increasingly adopting advanced plastics for weight reduction and fuel efficiency. Government policies promoting eco-friendly materials and recycling initiatives are key growth drivers. The demand for high-performance plastics is also rising, influenced by stringent safety regulations and consumer preferences.

South Korea : Competitive Landscape and Innovation

South Korea holds a 1.8% share in the automotive plastics market, bolstered by a robust automotive industry. Key growth drivers include the increasing production of electric vehicles and advancements in material technology. The government supports this growth through incentives for sustainable practices. Major cities like Seoul and Busan are pivotal markets, with significant investments from local players like LG Chem and global firms.

Malaysia : Strategic Location and Development

Malaysia's automotive plastics market represents 0.8% of the APAC total, with growth driven by strategic investments in manufacturing and infrastructure. The government's focus on enhancing the automotive sector through policies like the National Automotive Policy supports market expansion. Demand for lightweight materials is increasing, particularly in the automotive and electronics sectors, reflecting changing consumer preferences.

Thailand : Export-Oriented Market Dynamics

Thailand accounts for 0.7% of the automotive plastics market, benefiting from its status as a manufacturing hub. The country's automotive industry is export-oriented, with significant investments from global automakers. Government initiatives to promote local production and sustainability are driving demand for advanced plastics. Key cities like Bangkok and Chonburi are central to this growth, hosting major automotive plants.

Indonesia : Untapped Potential in Automotive Sector

Indonesia's automotive plastics market, at 0.6%, is on the rise, driven by increasing vehicle ownership and urbanization. The government is implementing policies to boost local manufacturing and attract foreign investment. Demand for lightweight and durable materials is growing, particularly in the automotive and consumer goods sectors. Key cities like Jakarta are becoming focal points for market development.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC holds a 0.65% share in the automotive plastics market, characterized by diverse economic conditions and regulatory environments. Growth is driven by varying demand trends across countries, influenced by local automotive industries and consumer preferences. Government initiatives to promote sustainability and innovation are shaping market dynamics, with opportunities in emerging economies.