Increasing Water Scarcity

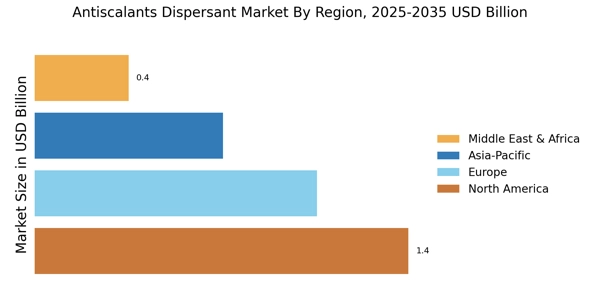

The rising concern over water scarcity is a pivotal driver for the Antiscalants Dispersant Market. As industries and municipalities face challenges in sourcing adequate water supplies, the demand for efficient water treatment solutions escalates. Antiscalants and dispersants play a crucial role in preventing scale formation in water systems, thereby enhancing the efficiency of water usage. According to recent estimates, the global water scarcity issue could affect over 2 billion people by 2025, prompting industries to adopt advanced water treatment technologies. This trend is likely to propel the Antiscalants Dispersant Market as companies seek to optimize their water management practices and ensure sustainable operations.

Industrial Growth and Expansion

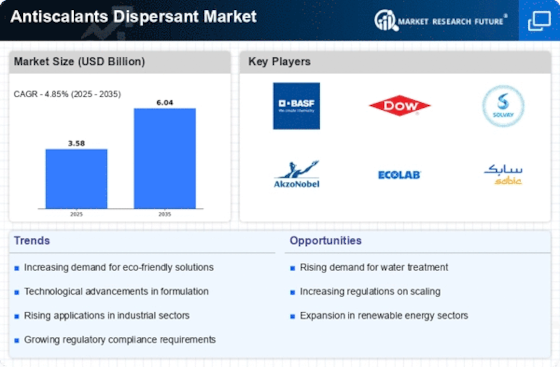

The ongoing industrial growth across various sectors, including oil and gas, power generation, and manufacturing, significantly influences the Antiscalants Dispersant Market. As these industries expand, the need for effective water treatment solutions becomes increasingly critical. For instance, the oil and gas sector, which is projected to grow at a compound annual growth rate of approximately 5% over the next few years, relies heavily on antiscalants to maintain operational efficiency. The Antiscalants Dispersant Market is poised to benefit from this industrial expansion, as companies seek to mitigate scaling issues that can lead to costly downtime and maintenance.

Regulatory Pressures for Water Quality

Regulatory frameworks aimed at improving water quality and environmental sustainability are exerting pressure on industries to adopt effective water treatment solutions. The Antiscalants Dispersant Market is directly impacted by these regulations, as companies are mandated to comply with stringent water quality standards. For instance, regulations set forth by environmental agencies often require the use of antiscalants to prevent scale buildup in water systems, thereby ensuring compliance. This regulatory landscape is likely to drive the demand for antiscalants and dispersants, as industries strive to meet legal requirements while maintaining operational efficiency.

Technological Innovations in Water Treatment

Technological advancements in water treatment processes are reshaping the Antiscalants Dispersant Market. Innovations such as membrane filtration, advanced oxidation processes, and real-time monitoring systems are enhancing the effectiveness of antiscalants and dispersants. These technologies not only improve the performance of water treatment systems but also reduce operational costs. The integration of smart technologies is expected to drive the market further, as industries increasingly adopt automated solutions for water management. As a result, the Antiscalants Dispersant Market is likely to witness a surge in demand for innovative products that align with these technological trends.

Growing Awareness of Environmental Sustainability

The increasing awareness of environmental sustainability among consumers and businesses is a significant driver for the Antiscalants Dispersant Market. As organizations strive to reduce their environmental footprint, the demand for eco-friendly water treatment solutions is on the rise. Antiscalants and dispersants that are biodegradable and non-toxic are becoming more sought after, aligning with the sustainability goals of various industries. This shift towards environmentally responsible practices is expected to propel the Antiscalants Dispersant Market, as companies seek to implement solutions that not only enhance operational efficiency but also contribute to environmental conservation.