Antimony Market Summary

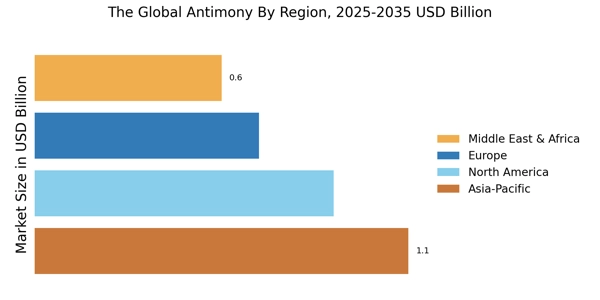

As per Market Research Future analysis, The Antimony Market Size was valued at USD 2,334.2 Million in 2024. The Antimony industry is projected to grow from USD 2,455.5 Million in 2025 to USD 4,076.7 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.20% during the forecast period (2025–2035).

Key Market Trends & Highlights

The Antimony Market exhibits moderate growth amid supply constraints and rising demand from flame retardants and batteries

- Increasing demand for flame retardants, rising use in lead-acid batteries, and growing applications in the chemical and automotive sectors are the key market drivers enhancing market growth.

- Flame retardants dominate at usage, propelled by stricter fire safety rules in construction and textiles; antimony trioxide remains key despite halogen-free shifts.

- Nano-enhanced alloys improve battery life and solar efficiency.Halogen-free alternatives blend antimony with phosphorus to meet regulations.

- Steady growth driven by flame retardants, batteries, and supply diversification efforts and Plastics and cables grow via infrastructure booms in Asia.

- Lead-acid battery demand persists in automotive and energy storage, while semiconductors drive high-purity needs amid EV and 5G expansion.

Market Size & Forecast

| 2024 Market Size | 2,334.2 (USD Million) |

| 2035 Market Size | 4,076.7 (USD Million) |

| CAGR (2025 - 2035) | 5.20% |

Major Players

Hunan Chenzhou Mining Group Co., Ltd., Mandalay Resources Ltd., United States Antimony Corporation, AMG Advanced Metallurgical Group N.V., BASF SE, Campine NV, Korea Zinc Co., Ltd., Recyclex S.A., Huachang Antimony Industry, and Village Main Reef Ltd.