Growing Awareness of Infection Prevention

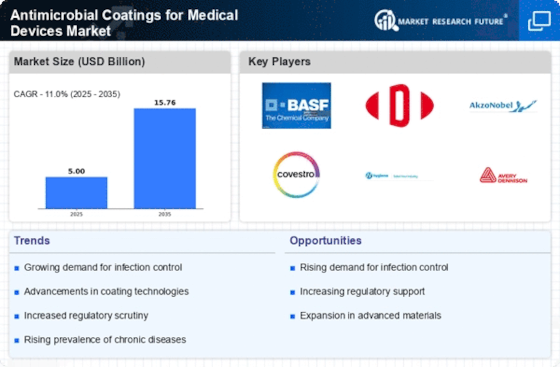

The growing awareness of infection prevention among healthcare professionals and patients is significantly influencing the Antimicrobial Coatings for Medical Devices Market. Educational initiatives and campaigns aimed at highlighting the importance of infection control are fostering a culture of safety within healthcare settings. As awareness increases, healthcare providers are more likely to adopt antimicrobial coatings as a proactive measure to protect patients from infections. This shift in mindset is reflected in market trends, with a notable increase in the adoption of antimicrobial-coated devices across various medical sectors, including surgical instruments and implantable devices. Market forecasts indicate that this heightened awareness could contribute to a market growth rate of approximately 11% over the next few years. Consequently, the emphasis on infection prevention is likely to remain a driving force in the industry.

Rising Demand for Advanced Medical Devices

The rising demand for advanced medical devices is a pivotal driver for the Antimicrobial Coatings for Medical Devices Market. As healthcare technology evolves, there is a growing need for devices that not only perform effectively but also minimize the risk of infections. This demand is particularly evident in sectors such as orthopedics, cardiology, and surgical instruments, where the integration of antimicrobial coatings is becoming increasingly standard. Market data suggests that the global market for advanced medical devices is expected to reach several billion dollars in the coming years, with antimicrobial coatings playing a crucial role in enhancing device performance and safety. The anticipated growth in this sector is likely to propel the demand for antimicrobial coatings, with projections indicating a compound annual growth rate of around 10% as manufacturers respond to the evolving needs of healthcare providers.

Regulatory Support for Antimicrobial Solutions

Regulatory bodies are increasingly supporting the development and adoption of antimicrobial solutions in the Antimicrobial Coatings for Medical Devices Market. Agencies such as the Food and Drug Administration are establishing guidelines that encourage the use of antimicrobial coatings to enhance patient safety. This regulatory backing not only facilitates faster approval processes for new products but also instills confidence among healthcare providers regarding the efficacy of these coatings. As a result, manufacturers are more inclined to invest in research and development, leading to a broader range of antimicrobial products entering the market. The anticipated growth in regulatory support is expected to drive market expansion, with estimates suggesting a potential increase in market value by over 15% in the next few years. This trend underscores the importance of compliance and innovation in shaping the future of the industry.

Technological Innovations in Coating Applications

Technological advancements in coating applications are propelling the Antimicrobial Coatings for Medical Devices Market forward. Innovations such as nanotechnology and advanced polymer formulations are enhancing the efficacy and durability of antimicrobial coatings. These developments allow for the creation of coatings that not only provide long-lasting protection against pathogens but also maintain biocompatibility with medical devices. The integration of smart technologies, such as self-cleaning surfaces, is also gaining traction, further expanding the potential applications of antimicrobial coatings. Market analysts indicate that the introduction of these cutting-edge technologies could lead to a substantial increase in market share, with projections estimating a growth rate of approximately 12% over the next five years. As manufacturers adopt these innovations, the competitive landscape of the industry is expected to evolve, fostering a more dynamic market environment.

Increasing Incidence of Healthcare-Associated Infections

The rising incidence of healthcare-associated infections (HAIs) is a critical driver for the Antimicrobial Coatings for Medical Devices Market. According to the Centers for Disease Control and Prevention, HAIs affect millions of patients annually, leading to increased morbidity and healthcare costs. This alarming trend has prompted healthcare facilities to seek innovative solutions to mitigate infection risks. Antimicrobial coatings are increasingly recognized for their ability to reduce microbial colonization on medical devices, thereby enhancing patient safety. The market for these coatings is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As healthcare providers prioritize infection control, the demand for antimicrobial coatings is likely to surge, positioning them as a vital component in the fight against HAIs.