Emergence of Fintech Companies

The emergence of fintech companies is reshaping the landscape of the Anti-Money Laundering Systems Market. These innovative firms are leveraging technology to provide financial services, often with less regulatory oversight than traditional banks. As a result, they face unique challenges in implementing effective anti-money laundering measures. The need for robust AML systems is critical for fintechs to build trust and ensure compliance with regulatory standards. The market for AML solutions tailored to fintech companies is expected to grow significantly, as these firms seek to mitigate risks associated with money laundering. This trend indicates a dynamic shift in the market, as traditional and new players adapt to evolving compliance requirements.

Heightened Regulatory Scrutiny

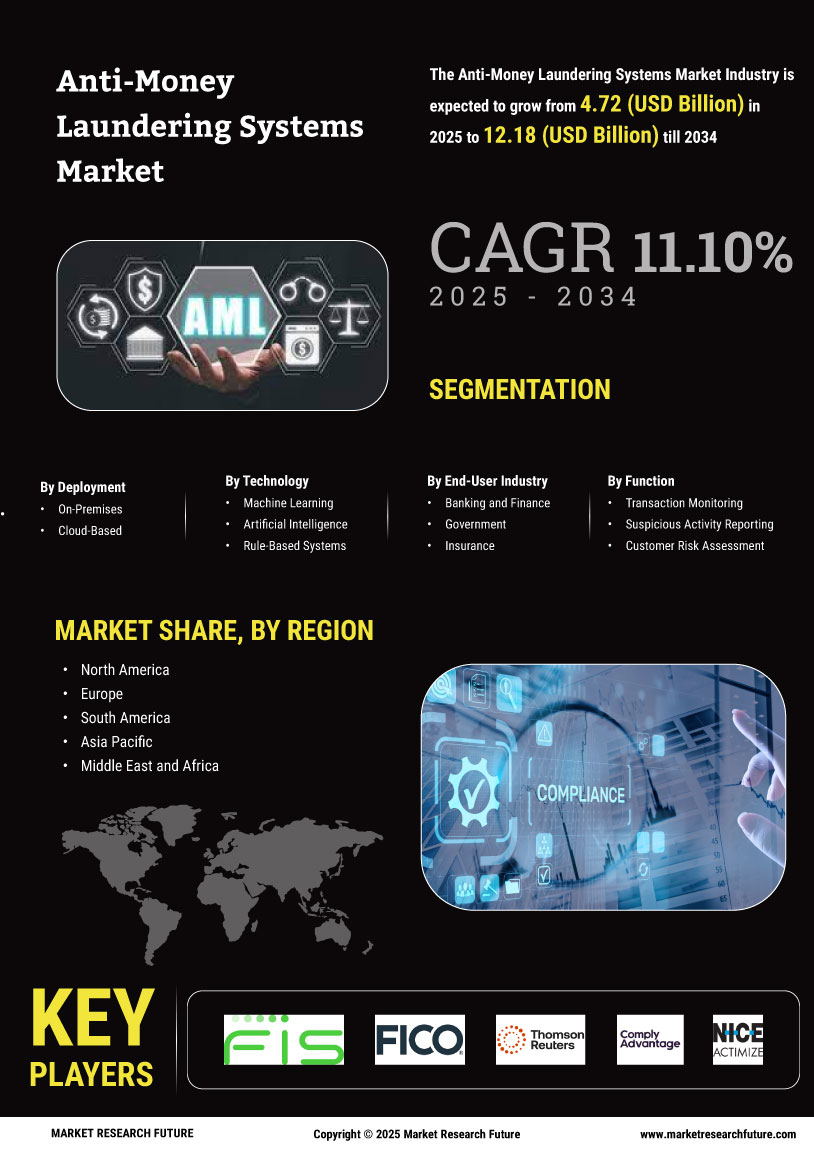

The Anti-Money Laundering Systems Market is experiencing heightened regulatory scrutiny as governments and financial authorities worldwide implement stricter compliance measures. Regulatory bodies are mandating enhanced due diligence and reporting requirements, compelling institutions to invest in advanced AML systems. The Financial Action Task Force (FATF) has introduced new guidelines that necessitate robust monitoring and reporting mechanisms. This regulatory pressure is expected to drive the market, as institutions seek to avoid hefty fines and reputational damage associated with non-compliance. The market for anti-money laundering solutions is anticipated to reach USD 3 billion by 2025, reflecting the urgency for compliance-driven investments.

Increasing Financial Crime Activities

The rise in financial crime activities, including money laundering and fraud, is a significant driver for the Anti-Money Laundering Systems Market. Criminal organizations are employing increasingly sophisticated methods to disguise illicit funds, prompting financial institutions to enhance their detection capabilities. Reports indicate that global money laundering activities could amount to USD 2 trillion annually, underscoring the urgency for effective AML systems. As financial institutions face mounting pressure to safeguard their operations, the demand for advanced anti-money laundering solutions is likely to surge. This trend suggests a robust growth trajectory for the market, as institutions prioritize investments in technologies that can effectively combat financial crime.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the Anti-Money Laundering Systems Market is transforming how financial institutions detect and prevent illicit activities. AI algorithms can analyze vast amounts of transaction data in real-time, identifying patterns and anomalies that may indicate money laundering. This capability enhances the efficiency of compliance teams, allowing them to focus on high-risk transactions. According to recent estimates, the AI segment within the Anti-Money Laundering Systems Market is projected to grow at a compound annual growth rate of over 25% through 2026. As financial institutions increasingly adopt AI-driven solutions, the demand for sophisticated anti-money laundering systems is likely to rise, further propelling market growth.

Growing Awareness of Financial Integrity

There is a growing awareness of the importance of financial integrity among businesses and consumers, which is driving the Anti-Money Laundering Systems Market. Stakeholders are increasingly recognizing that robust anti-money laundering practices are essential for maintaining trust in the financial system. This awareness is prompting organizations to invest in comprehensive AML solutions to protect their reputations and ensure compliance with regulations. As businesses strive to demonstrate their commitment to ethical practices, the demand for effective anti-money laundering systems is likely to increase. This trend suggests a positive outlook for the market, as organizations prioritize investments in AML technologies to enhance their operational integrity.