Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is a significant driver for the Antihypertensive Drugs Market. As countries invest more in healthcare infrastructure and services, access to antihypertensive medications improves, leading to higher consumption rates. For example, healthcare spending in several developed nations has seen a steady rise, with a focus on chronic disease management, including hypertension. This trend is expected to continue, as governments and private sectors recognize the importance of managing hypertension to reduce long-term healthcare costs associated with cardiovascular diseases. Consequently, the Antihypertensive Drugs Market stands to benefit from this increased investment, as more resources are allocated to the development and distribution of effective antihypertensive therapies.

Growing Awareness and Education

The growing awareness and education regarding hypertension and its associated risks are pivotal in driving the Antihypertensive Drugs Market. Public health campaigns and initiatives aimed at educating individuals about the importance of regular blood pressure monitoring and management have led to increased diagnosis and treatment rates. As more people become aware of the dangers of uncontrolled hypertension, the demand for antihypertensive medications is likely to rise. Furthermore, healthcare professionals are increasingly emphasizing the need for early intervention and effective management strategies, which further propels the market. This heightened awareness not only encourages individuals to seek treatment but also fosters a more proactive approach to managing hypertension, thereby positively impacting the Antihypertensive Drugs Market.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for new antihypertensive drugs are crucial drivers of the Antihypertensive Drugs Market. Regulatory agencies are increasingly recognizing the need for innovative treatments to address the growing burden of hypertension. As a result, there has been a trend towards expedited review processes for promising new therapies, which can significantly shorten the time to market. This regulatory environment encourages pharmaceutical companies to invest in research and development of novel antihypertensive agents. Moreover, the approval of new drugs often leads to increased competition, which can drive down prices and improve access for patients. Consequently, the supportive regulatory landscape is likely to foster growth and innovation within the Antihypertensive Drugs Market.

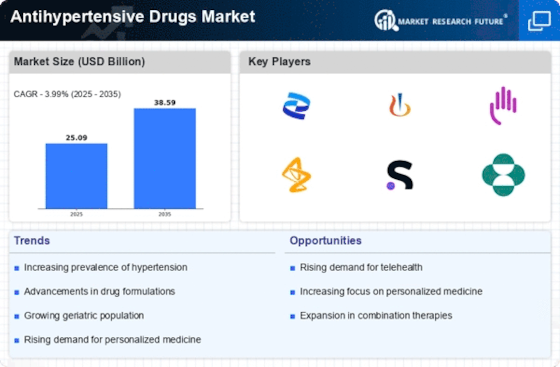

Advancements in Drug Formulations

Innovations in drug formulations are significantly influencing the Antihypertensive Drugs Market. The development of novel drug delivery systems, such as extended-release formulations and combination therapies, enhances the efficacy and patient compliance of antihypertensive medications. For instance, the introduction of fixed-dose combinations allows for simplified treatment regimens, which can improve adherence among patients. Market data indicates that combination therapies are projected to account for a substantial share of the antihypertensive market, as they offer synergistic effects and reduce pill burden. Additionally, advancements in nanotechnology and targeted drug delivery systems may further revolutionize the treatment landscape, providing more effective and personalized options for patients. This ongoing innovation is likely to drive growth in the Antihypertensive Drugs Market.

Increasing Prevalence of Hypertension

The rising prevalence of hypertension is a primary driver for the Antihypertensive Drugs Market. According to recent estimates, nearly 1.13 billion people worldwide suffer from hypertension, a condition that significantly increases the risk of heart disease and stroke. This alarming statistic underscores the urgent need for effective antihypertensive therapies. As awareness of hypertension grows, more individuals are seeking treatment, thereby expanding the market for antihypertensive drugs. Furthermore, the aging population is likely to exacerbate this trend, as older adults are more susceptible to hypertension. Consequently, pharmaceutical companies are focusing on developing innovative antihypertensive medications to meet the increasing demand, which is expected to propel the Antihypertensive Drugs Market forward.