Environmental Concerns

Growing environmental awareness is influencing the Global Anti-Graffiti Coatings Market Industry, as consumers and businesses increasingly prefer eco-friendly products. Traditional coatings often contain harmful chemicals, whereas newer formulations focus on sustainability and reduced environmental impact. This shift is evident in the development of biodegradable and low-VOC coatings that meet stringent environmental regulations. Companies are responding to this demand by innovating and offering greener alternatives, which may attract a broader customer base. As a result, the market is expected to grow at a CAGR of 3.5% from 2025 to 2035, reflecting the increasing importance of sustainability in coating solutions.

Government Initiatives

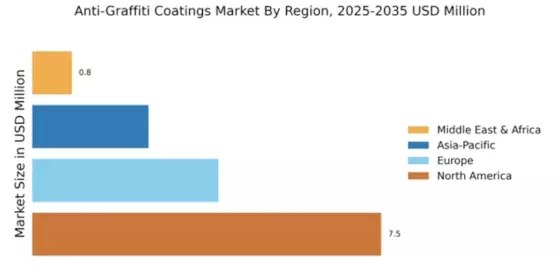

Government initiatives aimed at beautifying public spaces and reducing vandalism are driving the Global Anti-Graffiti Coatings Market Industry. Various local and national governments are allocating funds for anti-graffiti programs, which often include the application of specialized coatings on public infrastructure. For example, initiatives in cities such as Chicago and London have led to the implementation of anti-graffiti coatings on public transport systems and historical buildings. These efforts not only enhance aesthetic appeal but also reduce maintenance costs over time, contributing to a market growth projection of 108.7 USD Million by 2035.

Increasing Urbanization

The rapid pace of urbanization globally contributes to the growth of the Global Anti-Graffiti Coatings Market Industry. As cities expand, the prevalence of graffiti on public and private properties increases, necessitating effective protective solutions. Urban areas, particularly in developing nations, are witnessing a surge in graffiti vandalism, prompting municipalities to invest in anti-graffiti coatings. For instance, cities like Los Angeles and New York have implemented programs to combat graffiti, leading to a projected market value of 74.5 USD Million in 2024. This trend indicates a growing recognition of the need for protective coatings in urban environments.

Technological Advancements

Technological advancements in coating formulations are enhancing the performance and durability of anti-graffiti products, thereby propelling the Global Anti-Graffiti Coatings Market Industry. Innovations such as nanotechnology and advanced polymer chemistry are leading to the development of coatings that offer superior resistance to graffiti and environmental degradation. These advancements not only improve the longevity of coatings but also reduce the frequency of reapplication, which is economically beneficial for property owners. As a result, the market is witnessing increased adoption of these high-performance coatings, further solidifying its growth trajectory.

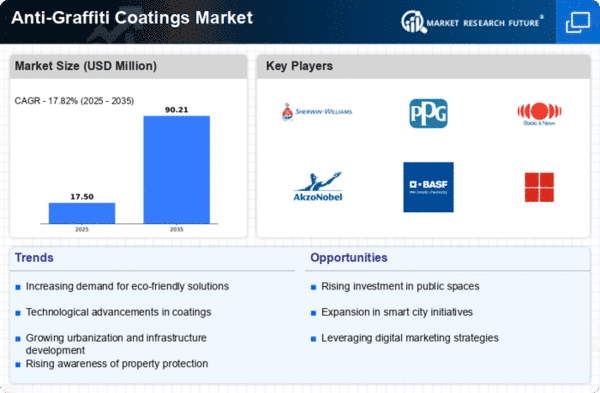

Market Trends and Projections

The Global Anti-Graffiti Coatings Market Industry is projected to experience steady growth, with key trends indicating a robust future. The market is expected to reach a valuation of 74.5 USD Million in 2024, with further growth anticipated to 108.7 USD Million by 2035. The compound annual growth rate (CAGR) for the period from 2025 to 2035 is estimated at 3.5%. These figures suggest a consistent demand for anti-graffiti solutions, driven by urbanization, government initiatives, and technological advancements. The market's trajectory appears promising, reflecting a growing recognition of the importance of protective coatings in various sectors.

Rising Property Maintenance Costs

The rising costs associated with property maintenance are driving demand for anti-graffiti solutions within the Global Anti-Graffiti Coatings Market Industry. Property owners are increasingly aware that graffiti can lead to significant repair and cleaning expenses, prompting them to invest in preventive measures. By applying anti-graffiti coatings, property owners can mitigate the financial burden of graffiti removal and maintain property value. This trend is particularly evident in commercial real estate, where maintaining a pristine appearance is crucial for attracting tenants and customers. Consequently, this growing awareness is likely to contribute to sustained market growth.