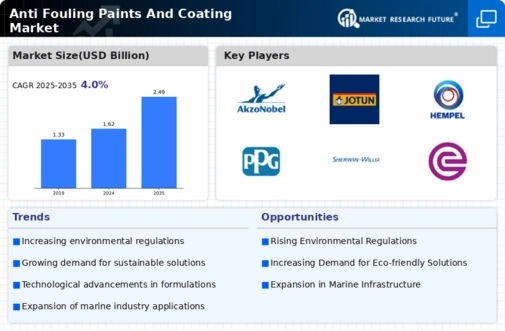

Growth in Aquaculture Industry

The expansion of the aquaculture industry is likely to serve as a significant driver for the Anti Fouling Paints And Coating Market. As the demand for seafood continues to rise, aquaculture operations are increasing, necessitating the use of anti-fouling coatings on fish farming equipment and vessels. This sector is projected to grow at a rate of approximately 4% annually, driven by the need for sustainable seafood production. Anti-fouling paints play a critical role in maintaining the efficiency and longevity of aquaculture facilities by preventing the growth of unwanted organisms. Consequently, the growth of aquaculture is expected to create substantial opportunities for manufacturers of anti-fouling coatings, as they seek to provide solutions tailored to this expanding market.

Rising Demand for Marine Vessels

The increasing demand for marine vessels, particularly in the shipping and recreational sectors, appears to be a primary driver for the Anti Fouling Paints And Coating Market. As global trade expands, the need for efficient and durable vessels becomes paramount. According to recent data, the shipping industry is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. This growth necessitates the use of anti-fouling coatings to enhance vessel performance and longevity. Furthermore, recreational boating is witnessing a resurgence, with more individuals investing in personal watercraft. This trend is likely to bolster the demand for high-quality anti-fouling paints, as boat owners seek to protect their investments from marine growth and corrosion.

Environmental Regulations and Standards

The tightening of environmental regulations and standards is likely to significantly influence the Anti Fouling Paints And Coating Market. Governments and regulatory bodies are increasingly imposing restrictions on harmful substances in marine coatings, pushing manufacturers to innovate and develop eco-friendly alternatives. For instance, the International Maritime Organization has set ambitious targets for reducing emissions from ships, which indirectly affects the types of anti-fouling paints that can be used. The market is witnessing a shift towards biocide-free and low-VOC (volatile organic compounds) coatings, which are not only compliant with regulations but also appeal to environmentally conscious consumers. This regulatory landscape is expected to drive innovation and growth within the industry, as companies strive to meet new standards while maintaining performance.

Technological Innovations in Coating Solutions

Technological advancements in coating solutions are emerging as a crucial driver for the Anti Fouling Paints And Coating Market. Innovations such as the development of self-cleaning and biocide-free coatings are gaining traction, offering enhanced performance and reduced environmental impact. The introduction of nanotechnology in coatings is also noteworthy, as it improves adhesion and durability while minimizing fouling. Market data suggests that the segment of advanced coatings is expected to grow significantly, with a projected increase of around 5% annually. These technological innovations not only enhance the effectiveness of anti-fouling solutions but also cater to the evolving needs of consumers who prioritize sustainability and efficiency in their marine applications.

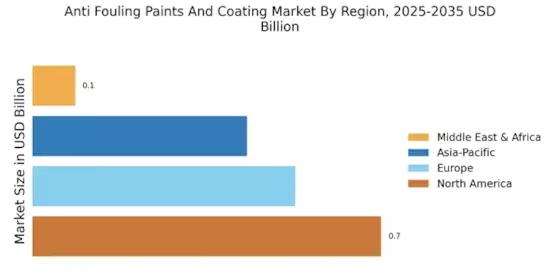

Increasing Investment in Infrastructure Development

The surge in infrastructure development, particularly in coastal regions, appears to be a vital driver for the Anti Fouling Paints And Coating Market. As countries invest in ports, marinas, and other marine infrastructure, the demand for protective coatings for these structures is likely to rise. Recent reports indicate that infrastructure spending is expected to increase by approximately 6% over the next few years, with a significant portion allocated to marine projects. This trend necessitates the use of anti-fouling paints to protect infrastructure from marine growth and corrosion, thereby extending the lifespan of these investments. As a result, the infrastructure boom is anticipated to create a favorable environment for the anti-fouling coatings market, driving growth and innovation.