Anti Aging Skincare Product Market Summary

As per Market Research Future analysis, the Anti-Aging Skincare Product Market was estimated at 85.12 USD Billion in 2024. The Anti-Aging Skincare Product industry is projected to grow from 91.8 USD Billion in 2025 to 194.5 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.80% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Anti-Aging Skincare Product Market is experiencing a dynamic shift towards natural and personalized solutions driven by technological advancements.

- The market is witnessing a notable rise in the demand for natural ingredients, reflecting a broader consumer preference for organic products.

- Personalized skincare solutions are gaining traction, as consumers seek tailored approaches to address their unique skin concerns.

- Integration of technology in skincare products is becoming increasingly prevalent, enhancing user experience and product efficacy.

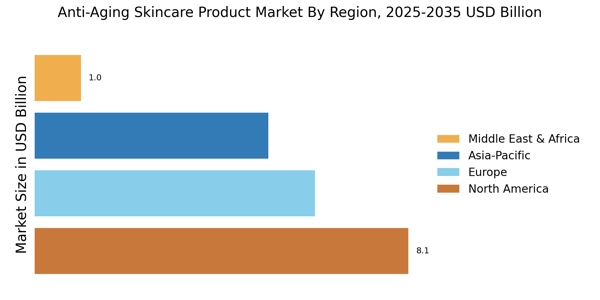

- The increasing aging population and growing awareness of skincare are major drivers propelling market growth, particularly in North America and the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 85.12 (USD Billion) |

| 2035 Market Size | 91.8 (USD Billion) |

| CAGR (2025 - 2035) | 7.80% |

Major Players

L'Oreal (FR), Estée Lauder (US), Procter & Gamble (US), Unilever (GB), Shiseido (JP), Johnson & Johnson (US), Beiersdorf (DE), Coty (US), Revlon (US)