Growth in Fluorinated Chemicals Production

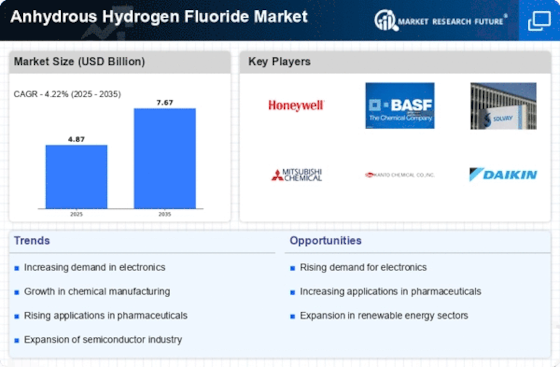

The Anhydrous Hydrogen Fluoride Market is poised for growth due to the increasing production of fluorinated chemicals. Anhydrous hydrogen fluoride serves as a precursor in the synthesis of various fluorinated compounds, which are essential in applications ranging from refrigerants to pharmaceuticals. The Anhydrous Hydrogen Fluoride Market is expected to expand significantly, with estimates suggesting a compound annual growth rate of around 5% through the next decade. This growth is likely to bolster the demand for anhydrous hydrogen fluoride, as manufacturers ramp up production to meet the needs of diverse industries. Consequently, the Anhydrous Hydrogen Fluoride Market stands to benefit from this upward trend, as it plays a crucial role in the supply chain of fluorinated products.

Rising Applications in Specialty Chemicals

The Anhydrous Hydrogen Fluoride Market is witnessing an increase in applications within the specialty chemicals sector. This chemical is integral in producing various specialty products, including agrochemicals, surfactants, and polymers. As industries seek to innovate and develop new formulations, the demand for anhydrous hydrogen fluoride is likely to rise. The specialty chemicals market is projected to grow at a rate of approximately 4% annually, indicating a favorable environment for the Anhydrous Hydrogen Fluoride Market. This growth is driven by the need for high-performance materials and the ongoing trend towards customization in chemical formulations, suggesting that anhydrous hydrogen fluoride will remain a vital component in the production of specialty chemicals.

Regulatory Support for Fluorine-Based Products

The Anhydrous Hydrogen Fluoride Market is likely to benefit from regulatory support aimed at promoting the use of fluorine-based products. Governments are increasingly recognizing the importance of fluorinated compounds in various applications, including energy-efficient technologies and medical advancements. This regulatory environment may encourage investment in the production and utilization of anhydrous hydrogen fluoride, as it is essential for creating these fluorinated products. Furthermore, as regulations evolve to support sustainable practices, the Anhydrous Hydrogen Fluoride Market could see enhanced opportunities for growth. The alignment of regulatory frameworks with industry needs suggests a favorable outlook for the market, as stakeholders seek to capitalize on the benefits of fluorine chemistry.

Advancements in Chemical Processing Technologies

The Anhydrous Hydrogen Fluoride Market is benefiting from advancements in chemical processing technologies. Innovations in production methods and purification techniques are enhancing the efficiency and safety of anhydrous hydrogen fluoride manufacturing. These advancements not only improve yield but also reduce environmental impact, aligning with the increasing emphasis on sustainability in chemical production. As companies adopt these new technologies, the overall cost of production may decrease, potentially leading to lower prices for end-users. This trend could stimulate demand across various sectors, further propelling the growth of the Anhydrous Hydrogen Fluoride Market. The integration of advanced technologies suggests a promising future for the industry, as it adapts to meet both market demands and regulatory standards.

Increasing Demand in Semiconductor Manufacturing

The Anhydrous Hydrogen Fluoride Market is experiencing a surge in demand due to its critical role in semiconductor manufacturing. As the electronics sector expands, the need for high-purity anhydrous hydrogen fluoride, utilized in etching silicon wafers, becomes increasingly pronounced. In 2025, the semiconductor industry is projected to reach a valuation of over 500 billion USD, driving the demand for this chemical. The precision and efficiency that anhydrous hydrogen fluoride offers in the production of microchips are pivotal, suggesting that its consumption will continue to rise as technology advances. This trend indicates a robust growth trajectory for the Anhydrous Hydrogen Fluoride Market, as manufacturers seek to enhance production capabilities and meet the evolving needs of the electronics market.